Well over a year on from our look into why graphics card prices often seem to be higher than their manufacturer suggested retail pricing (MSRP), it has continued on in much more dramatic fashion. Availability, and the ever-present fluctuations of supply and demand, have been the cause, but this time demand has skyrocketed because of graphics card-powered cryptocurrency mining. But most recently, there are indications that prices might finally be stabilizing and returning to more reasonable levels.

The last year or so has been hard on gamers looking to build their own PC, and the reason is tied primarily to cryptocurrency’s popularity. It’s been years since graphics cards were used en masse for Bitcoin mining, because the hardware arms race meant that specialized application-specific integrated chip (ASIC) mining hardware quickly overtook them. Ethereum mining, however, as with other digital currencies, doesn’t benefit in the same way from specialized hardware, and so graphics cards are a great solution for mining them, and that’s leading to stock shortages and price hikes.

In January, however, Nvidia stated that it was not happy with the current rising prices of GPUs and requested that retailers take action to ensure the needs of gamers were met before cryptocurrency miners.

“For Nvidia, gamers come first,” the company wrote in a comment to German website Computerbase.de. “All activities related to our GeForce product line are targeted at our main audience. To ensure that GeForce gamers continue to have good GeForce graphics card availability in the current situation, we recommend that our trading partners make the appropriate arrangements to meet gamers’ needs as usual.”

How high have prices gone? The once-humble Nvidia GeForce GTX 1060 retailed as low as $200 back in April 2017. As of January 2018, however, it wasn’t uncommon to see the GTX 1060 hit prices anywhere from $400 to $800.

The GTX 1080 Ti, meanwhile, has a retail price of $700. That’s been inflated to at least $1,000 on Newegg, with most cards going between $1,200 and $1,400. Amazon does no better. At the time, we couldn’t find any cards with stock direct from Amazon.com. Most listings, provided by third-party stores, were well above $1,000.

AMD’s cards have been hit just as badly. The once-inexpensive AMD Radeon graphics cards have seen their prices steadily rising over the past few months, culminating in stock problems around the world. Those show no signs of abating, though we may have finally reached a point where people aren’t willing to pay three times the MSRP for them. Vega 56 and 64 cards, like Nvidia’s GTX 1080 Ti, have regularly sold above $1,000. The company made an effort to curtail the issue with bundles that include a Vega video card with several other components, targeting them as gaming system builders, but the bundles sold out and the promotion has since ended.

It’s not clear what can solve this problem. Even bundles are a poor solution due to the high prices of cards. Scalpers could still make a tidy profit buying bundles, then reselling the cards and other hardware individually. Purchase limits have already appeared on some stores, but don’t to solve the issue. Again, due to high prices, scalpers swoop in on any available stock and quickly buy it out. Getting around a one-purchase-per-household rule isn’t hard for committed video card flippers.

Rumor has it that both AMD and Nvidia are working on releasing mining-focused graphics cards which would ship with a slightly lower price tag and no video connectors. That would make them useless for running a gaming PC, but perfect for mining rigs, and could help keep prices down on standard GPUs. That may finally present an option that has some impact on pricing, but few such cards have appeared so far.

For a while now, all gamers could do was stare at cryptocurrency prices and hope for a pause in their ascent — which has become something of a trend. Dampened enthusiasm for mining may all that could stop the current supply and price problems. And as of April, though, there appears to be some relief in sight, although the reasons aren’t yet fully understood.

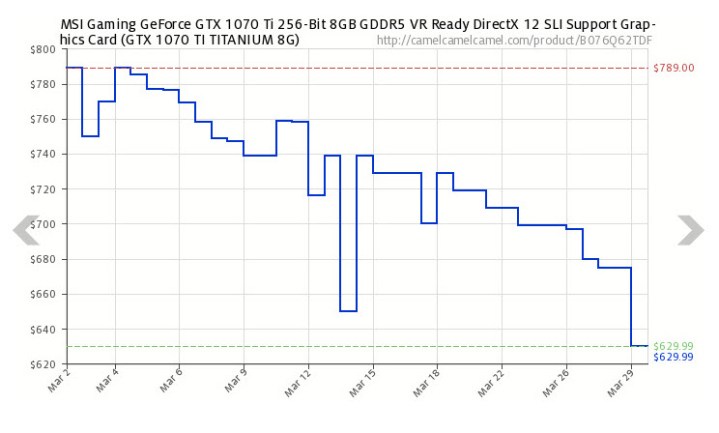

According to wccftech.com, which has kept a close eye on GPU pricing, supply appears to be finally stabilizing and prices are falling, in fact they were 25 percent lower in Marchfor a few popular cards. The Zotac Nvidia GeForce GTX 1080 TI AMP Extreme Core Edition, which peaked at $1,400 early in March, dropped to $979 by the end of the month. The MSI Radeon RX Vega 56 Air Boost dropped from its high of nearly $940 all the way down to just over $750. And the Asus Radeon RX 580 fell from $555 to $420.

There’s till plenty of room for GPU prices to drop before they reach pre-mining levels, and there’s hope that as Ethereum ASIC miner systems reach the market that GPU prices will finally fall to normal levels. In the meantime, it will be significantly less painful for anyone who simply needs to pick up a new GPU.

Updated on April 6: Revised to reflect recent drops in pricing.