It’s hard to believe that 2022 is about to wrap up in a few days and 2023 will be here shortly. Seriously, where does the time go? And boy, it has been a pretty crazy year when it comes to tech and, well, social media. And we know that the internet loves end-of-year recaps!

It’s a good time to reflect while also looking forward to new goals and resolutions. On the recap front, there are plenty of ways that you can see your activity from the past year. You can make your own Instafest Spotify festival with your most listened-to artists of the year, see how you spent your time on Reddit, what games you’ve played on your Nintendo Switch, or even make an Instagram Recap Reel — there are so many options.

But if you have an Apple Card and primarily use it for everything (like I do), you may not like this particular recap; your Apple Card will show you exactly where all your money has gone! Oops.

Using the Apple Card as my primary form of payment

Ever since the Apple Card came out in 2019, I’ve been using it as my primary form of payment whenever I can. I used to use my debit card because I didn’t like the idea of having a lot of credit card debt, but since Apple Card rewards you with Daily Cash, I figured why not? Getting some money back, no matter how small, for money that I’m spending anyway — and having it become available right away versus having to wait until the statement closes — is a win for me.

When I first opened up my Apple Card account, I had a pretty modest credit line of about $7,500. Since then, it has increased several times and is now my biggest line of available credit. I use it whenever I can, unless I have another card better suited for the purchase (i.e. gas or restaurants with my Costco Citi card), and pay it off every month.

Aside from the convenience of immediate Daily Cash rewards, another reason I love my Apple Card is because of the interface with the Wallet app on my iPhone 14 Pro with iOS 16. It looks so much nicer than typical bank apps, and merchant names are simple, with logos or icons that make identifying them easy. You can also see the amount of cash back earned from a purchase, your current balance, and how much credit is still available.

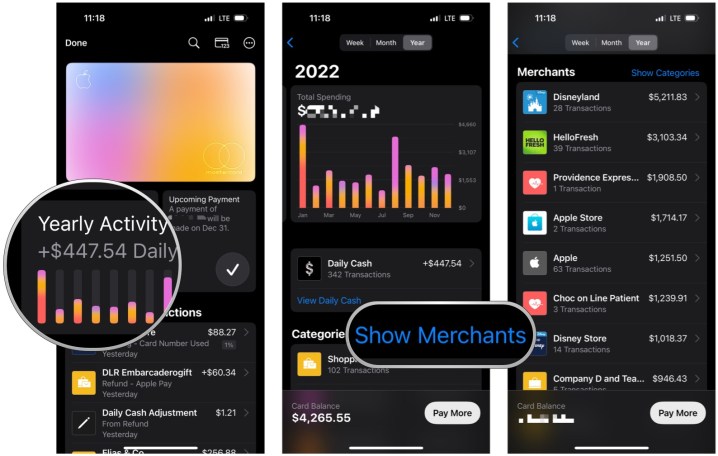

But Apple Card lets you do more than that. By tapping on the “Weekly Activity” tile, you can switch it over to Month or even Year. And viewing my yearly Apple Card recap is what I wish I didn’t see.

By default, whenever you view your weekly, monthly, or yearly history for Apple Card, it shows the categories. But you can change that to merchants instead, and my summary gave me an unexpected sticker shock.

But where has all my money gone?!?

Apparently, I have spent over $5,000 at Disneyland this year, which is my top merchant. That includes two Magic Key passes for my husband and me, paid in full, plus various event tickets, dining packages, and tours at the park. This does not include all the merchandise I’ve purchased online and at the various stores at the park, which would fall under their own merchant name.

https://twitter.com/christyxcore/status/1602941963791060992?s=20&t=JKHdzXKO_fl8yeS25Kk3Lg

My second merchant is HelloFresh, with over $3,000 spent in 2022. Hey, I like the convenience of picking out meals to cook instead of planning them myself, is that such a crime? I hate having to go to the store to buy ingredients to cook, largely because I end up forgetting or not in the mood, and the food just goes bad, thus becoming a waste of money. At least with HelloFresh, all of those meals have been cooked with no waste.

My third merchant was apparently the hospital, because giving birth is expensive, even with health insurance. My fourth merchant is the Apple Store because I had to have a 1TB iPhone 14 Pro, which composes 99% of that spent amount. And finally, my fifth merchant is Apple services and in-app purchases, fittingly.

How to view your own yearly Apple Card merchant recap

If you also use the Apple Card and want to find out exactly where your money has gone this year, here’s how to find out:

- Launch the Wallet app on your iPhone.

- Select your Apple Card.

- Select the Weekly/Monthly/Yearly Activity tile. It appears underneath the Card Balance tile.

- Make sure that the tab is on Year.

- Select Show Merchants to switch from the Category view.

- Allow your jaw to drop from shock if necessary.

A recap that may actually make you re-evaluate your choices

While a lot of other recaps are just for fun, seeing where all your money has gone in the past year might have more of an actual impact on your life. If you spent a lot but can afford it, then more power to you. But if your spending is a little out of control and you’re having some trouble keeping up with the bills without accruing interest, perhaps it’s time to actually reflect and see if you can lower your spending. I mean, no one likes to be in debt.

I’m just a little shocked at myself for how much I have actually spent at a single place this year. But hey, I’m keeping the lights on, right? Still, I think I should tone it down just a teeny tiny bit …