Update 5-21-2014: GoPro continues with its IPO filing, and it’s almost there. The company has tapped J.P. Morgan, Barclays, and Citigroup as lead underwriters. The company would trade on Nasdaq under the symbol GPRO.

GoPro has grown tremendously since coming on the scene, with a commanding presence in the POV action cam market. But the company is poised to get even bigger: GoPro is in the process of going public, and has filed the paperwork for the initial public offering, according to TechCrunch. Once the Securities and Exchange Commission completes its review, GoPro will become a public company.

This isn’t the first time GoPro has planned for an IPO. In 2012, IPO plans were put aside after it secured $200 million in private investment from Foxconn, which saw GoPro’s value shoot up to $2.25 billion. But CEO Nicholas Woodman said there were still plans to go public. Indeed, the new IPO plans may be the reason why GoPro brought in former Qualcomm Atheros SVP Jack Lazar as its new chief financial officer; Lazar has a lot of experience with these things.

For a company that started with $64,000 to making more than $500 million on its cameras – profit that traditional camera companies could only hope for these days – the company could become a Wall Street darling should the IPO go through. Woodman even hinted that GoPro might exceed $1 billion in revenue for 2013. It’d be interesting to see, with shareholders to account for, where the company plans to go when it becomes a public entity.

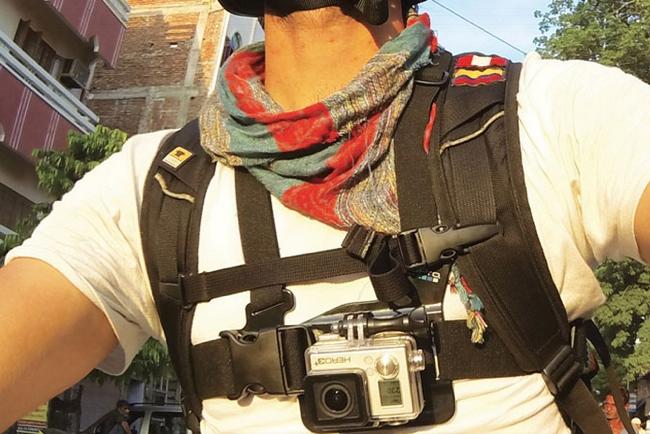

(Image via GoPro)