While you could always go out and try to file your taxes on your own, let’s face the facts and admit that you’ll feel more secure when you use tax software designed for individuals. There’s a much lower chance that you’ll forget something important when a program guides you through the process, and you might even score a bigger tax refund than you were expecting when a program searches for things likely to help you.

But nowadays there are so many tax software creators out there, vying for your attention. And almost all of them seem to be offering something for free. How is the user experience, though? And do they offer professional tax advice when you have a unique situation that doesn’t fit perfectly in a dropdown box? Getting the best tax software filing suite for your circumstance is important, but which one will that be?

The best tax software

- Use if you want the most thorough and helpful tax software.

- Use as a great TurboTax alternative.

- Use if you’re experienced and want a no-frills tax experience.

- Use if you’re a seasoned pro that wants a little bit of guidance.

- Use if you want to cut out the extra steps and dive straight into your taxes.

TurboTax

Best overall tax software

| Pros | Cons |

| Intuitive interface | Many features gated behind extra pay |

| Optional audit protection plan available | |

| Multiple way to interact with help |

TurboTax from Intuit remains one of the most popular tax software options, and for good reason. The TurboTax system is easy to use, offers numerous explanations for all things tax-related, and has strong compatibility with past filings. The question-and-answer format makes filing on your own very easy, and there are online chat rooms with tax experts that you can consult should you run into anything too weird. The software also excels at helping you find deductions and ways to save more money.

There are a few issues worth noting, however. The interface can get a bit confusing when you are looking directly at your tax forms rather than using the TurboTax question format, which may make it difficult to find a specific form or answer a certain question not covered by the walkthrough. Also, TurboTax has some of the highest fees if you have taxes more complex than a basic filing, so be prepared to pay.

| TurboTax 2023/2024 Price Guide | |||

| Plan | Starting price | Extra cost per state |

Covers |

| TurboTax | $0-$89 | $0-$39 per State | DIY tax filing with TurboTax software |

| TurboTax Live Assisted | $0-$169 | $0-$49 per State | TurboTax software plus on-demand tax expert help |

| TurboTax Live Full Service | $89 | $49 per State | Expert files taxes for you, remotely |

*Note: TurboTax has many more plans for advanced situations. Only basic plans are listed above. Additionally, add-ons for particular tax situations may apply. These may cost extra. Some prices include discounts available at the time of this writing. This may change as the tax year continues.

H&R Block

Best full-service tax prep software

| Pros | Cons |

| Low stress question and answer format | State filing can be expensive |

| Convenient help | |

| Also has in-office locations |

H&R Block’s services span apps, full programs, in-office visits, credit cards, and much more: It’s a nice variety of options if you like choosing how to deal with your taxes, or you need some combination of digital self-filing and tax services to get everything done. Their primary tax program, however, is very similar to TurboTax, with a friendly interface and question-and-answer format that hides most of the real tax documents until the end. There are still plenty of online help and chat services, but it’s nice to have the option to make a real-world appointment if you want to. Keep an eye on extra charges for state filing though, as this is where H&R Block really raises the fees.

| H&R Block 2023/2024 Price Guide | |

| Base filing price | From $85 |

| State returns | $70 each |

| Add-ons | Vary, include extra forms, credits, etc. |

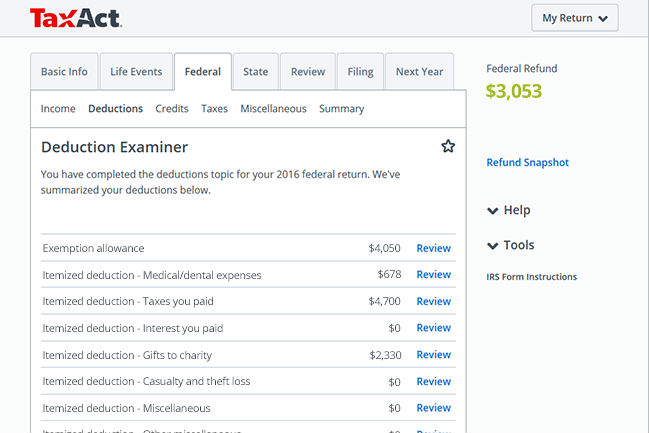

TaxAct

Best tax software for experienced customers

| Pros | Cons |

| More streamlined than other services | State taxes not free |

| Great for simple tax scenarios | |

| Gathers most relevant forms for you |

TaxAct (once TaxEdge) takes you through your Life Events in the past year, and then walks you through how these events affect your state and income taxes, giving you the information you need to fill out the appropriate forms (although it won’t autofill everything for you).

Think of TaxAct as a simplified version of the TurboTax format that may be more suited to people who have been using tax programs for a while and don’t need so much handholding. You can download TaxAct software, but the program is also available in an online format that allows you to save more money, so we suggest starting with that option. Otherwise, basic scenarios like owning a home or investments can become very expensive to purchase. Note that adding a state will cost $40 or $45 in additional fees depending on your initial package.

| TaxAct 2023/2024 Price Guide | |||

| Plan | Cost | Cost with Expert Help | Who it is for |

| Free / Free plus Xpert | $0 + $40/state | $60 + $40/state | Those with certain income levels and needs. |

| Deluxe | $30 + $40/state | $90 + $40/state | Homeowners and families. |

| Premier | $40 + $40/state | $100 + $40/state | Investors, foreign bank account holders, etc. |

| Self-Employed | $70 + $40/state | $130 + $40/state | Independent contractors, freelancers, and gig workers |

*Note: All prices include discounts available at the time of this writing. This may change as the tax year continues.

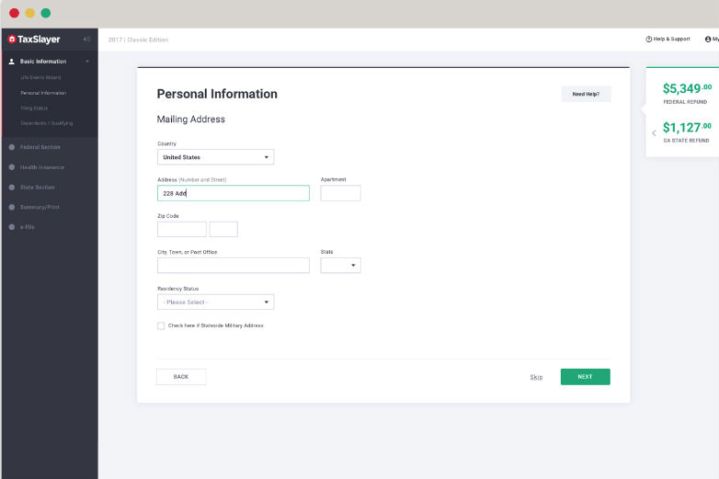

TaxSlayer

Best tax software for tax pros

| Pros | Cons |

| Used by professionals | Might be difficult for beginners |

| Includes phone support | |

| Highly affordable |

TaxSlayer is another highly affordable option that you can use to save money on the download or save even more by filing your own taxes instead of hiring someone else to do it. The software has a simple, clean interface that turns your tax forms into basic digital information fill-outs, removing the confusion from tracking your tax documentation.

Some professional accountants use TaxSlayer to help prepare their client’s taxes, so it does help to know the general layout of your taxes and what needs to be filled out this year (although there is a Guide Me option to make things easier). Searching through the forms is particularly quick here, thanks to powerful search tools. There are chat and phone support services if you get stuck at any part. Basic returns can be filed for free.

| TaxSlayer 2023/2024 Price Guide | ||

| Plan | Price | Includes |

| Simply Free | $0 | Basic 1040 + one state |

| Classic | $23 + $40+/state | All income types |

| Premium | $43 + $40+/state | Tax pro live chat, skip-the-line phone/email support |

| Self-Employed | $53 + $40+/state | Business income expenses, 1099, Schedule C, audit defense |

*Note: Prices listed here are a “NOW” price and may increase as the tax year continues.

Liberty Tax

Best bare-bones tax software

| Pros | Cons |

| Easy forms | No free option |

| Simple auto-fill | |

| Great Spanish option |

There’s no free option for Liberty Tax, but the basic download comes with a variety of import tools to help you quickly gather your data from W-2s, last year’s return, ACA forms, and other documents. Some powerful auto-fill features ensure accurate information is transferred everywhere after just having to import it once. Otherwise, it’s a pretty simple program, although there is room for wizards that check for any important tax amendments and help you manage more complex scenarios.

However, it’s worth noting that while the Liberty Tax program is generally well-received, its brick-and-mortar establishment tends to have poor customer reviews, and so it may not be the best option for face-to-face help.

| Liberty Tax 2023/2024 Price Guide | |||||

| Plan | Price | Price with state returns |

Who it is for | Forms supported | Schedules supported |

| Basic | $46 | $83 | Simple tax situations (single, married no kids) | 1040, 8853 | A, B |

| Deluxe | $66 | $103 | More complex situations (kids, investments, homes) | 1040, 4562, 8829, 4136, 8839, 8853 | A, B, C |

| Premium | $86 | $123 | Self-employed people and those with less common income types | 1040, 4562, 8829, 4136, 4684, 4835, 8839, 8853 | A, B, C, E, F, K-1 |

*Note: All prices include discounts available at the time of this writing. This may change as the tax year continues.

How we chose these tax software suites

If you want to get started on your taxes, what do you look for? Probably the same things we did when looking for the best tax software currently available. Namely, accuracy of the software, ease-of-use, and solid pricing. Here’s a look at each of those factors in detail. Be sure to scroll to the bottom for our price comparison table.

Accuracy and reliability

There’s not a lot that really needs to be said here, the best tax software is accurate and reliable. The tax programs that we chose for our best are battle-tested and have been used for years. None are up-and-comers that haven’t seen their first tax season yet. In general, you should be able to trust that the tax software above will give you the most accurate return (or payment amount).

Ease of use

If we received a dollar every time a person that reminded you that you can file your taxes yourself actually did so, we’d still be working. Taxes are hard. Tax software should make it easier. But the way you want it to be easier depends on your and your experience level.

Some tax software, and especially TurboTax, approaches filling out your taxes like an adventure over coffee. Questions and clicks are doled out to you in reasonable amounts and your hand is held through most of the more difficult aspects of filing your taxes. This is superb for people that don’t know what they’re doing when it comes to tax forms. In other words, most people. We also included some tax software that takes the training wheels off to varying degrees, so you can enjoy a guided experience but not get bogged down by “conversational” software.

2023/2024 tax software price comparison

Taxes are all about money, so it only makes sense to think about the money. There are a ton of different plans to choose from, even from single tax software companies. For each of the best tax software companies, we included a plan pricing guide (based on the current price after tax software deals are include) to make your decision easier. Here, we attempt to compare pricing for the companies.

For each company, we’ve chosen a basic plan, average plan (basic situations), advanced plan (contractor work, extra tax situations), and state filing fee to compare prices. It’s truly impossible to compare these services perfectly — there is no 1-to-1 equivalent for Basic/Average/Advanced between them — and you may be prompted to purchase add-ons as you complete your tax preparation. As a result, be sure to use this table as a tool only and not your sole guide in the selection process.

| 2023/2024 Tax Software Price Comparison Chart | ||||

| Software | Basic plan | Average plan | Advanced plan | State filing |

| $0 | $89 | $169 | $40 | |

| N/A | $85 | N/A | $70 | |

| $0 | $30 | $70 | $40 | |

| $0 | $23 | $53 | $40 | |

| $46 | $66 | $86 | $37 | |

This article is managed and created separately from the Digital Trends Editorial team.