Uber isn’t budging on changing driver status from independent contractors to employees — in which case expenses would be reimbursed. However, the Stride Drive app can make it easier for drivers to track business expenses deductible in income tax reporting.

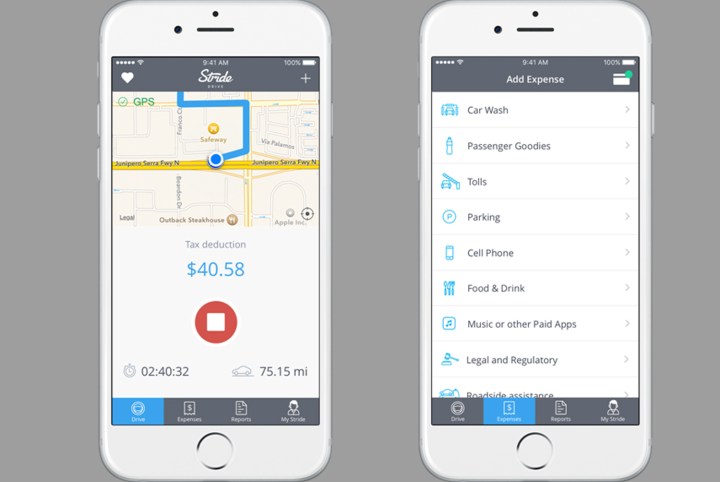

Rather than keeping track of mileage and other potentially deductible business expenses on scraps of paper, Stride Drive saves drivers time and hassle while they’re working. Preset categories for eligible rideshare driver expenses can help drivers maximize their business deductions and potentially reduce their income tax. Generic business expense trackers might not list all deductible expense types, which could result in drivers missing out on claiming legitimate deductions.

Real-time and weekly reports can help drivers know not only how their business is doing financially, but also how much they should be putting aside for tax payments.

Stride Health’s main business focus is health insurance for independent workers. Rideshare drivers are one of the company’s target markets. According to Stride Health, difficulty tracking business expenses could not only lead to higher income taxes due to unclaimed legitimate business expenses, but drivers could also miss out on government heath premium subsidies.

“While ensuring the physical health of drivers with better access to health care, we found an inextricable link between health and financial wellness,” said Noah Lang, CEO of Stride Health. “Drivers told us they need better tools to maximize their income. We built Stride Drive to make them a successful business of one, and to ensure their driving is as financially viable as possible.”

Stride Drive is currently available for iPhones only.