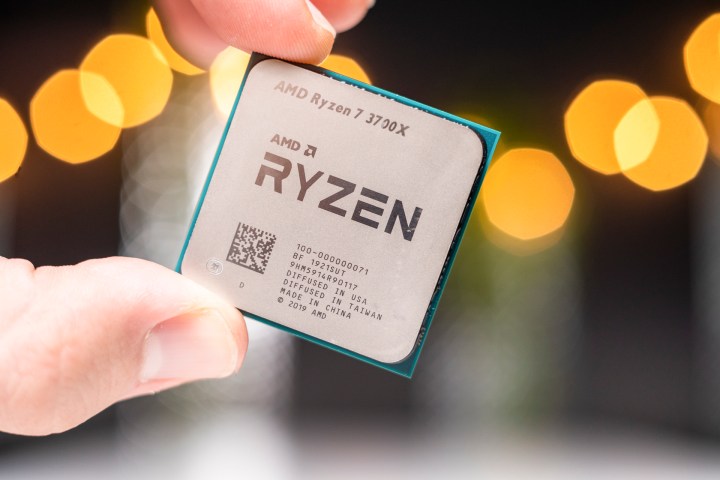

AMD has been on one giant winning streak ever since the release of its first-generation Ryzen processors in 2017 and it’s showing no signs of slowing. While that has translated to a large increase in its user base, some outlets and publications are reporting AMD market share has now hit 40%, which isn’t even close to the truth. AMD is doing well, but not that well. Yet.

Until the release of first generation Ryzen processors, everyone knew that if you wanted to bang for buck on a budget, you bought AMD. If you wanted anything else, especially gaming performance, you bought Intel. But that all changed with Ryzen. With AMD’s Ryzen 3000 CPUs, it’s almost been turned on its head with Intel having to cut prices to stay competitive.

Over the past few months we’ve seen reports of AMD dominating DIY markets in Germany, with more than 80% of CPU sales. Enthusiast groups overwhelmingly prefer AMD too, and most recently, the PassMark benchmark survey reported that 40% of its users were running AMD CPUs.

That’s an amazing statistic at face value. Some publications have reported at face value, suggesting that AMD now controls almost half of the processor market. But that’s just simply not true.

PassMark is a fantastic benchmark, but its user base is not universal or exhaustive. It focuses entirely on Intel and AMD CPUs, so doesn’t consider alternatives that make up a few scant percent of the total. It’s Windows-only, so excludes alternative operating systems like Chrome OS, Linux, and MacOS. It is also a benchmark that targets enthusiasts keen to test out their new system, so does not have a broad, mainstream demographic.

PassMark’s data points do show a significant increase in AMD CPUs running the benchmark, which suggests that more AMD CPUs have been bought by enthusiasts. But taken in isolation, those results could be misleading. Intel hasn’t released much in the way of desktop CPUs this year, whereas AMD has. That makes it more likely that new AMD CPU owners will want to test out their system and see what it can do, running benchmarks like PassMark. Intel CPU owners may be less inclined to do so.

If we look at some other data points to cross reference PassMark’s findings, things aren’t quite so rosy for the red team. In the Steam Hardware Survey, which encapsulates some 90 million monthly active gamers, Intel absolutely dominates with almost 84% of the market, while AMD languishes on just 16%. That’s on the back of a more than three percent surge for Intel in December 2019, destroying almost all the gains AMD had made throughout the months before.

Market research firm, Mercury Research, released a report in November which claimed that AMD’s desktop market share had increased to 18 percent, a rise of 5% year on year. Its share of the laptop space had jumped to 14.7%.

Intel maintains a dominant hold on the market and the global mindshare.

The most exciting stat for AMD in other reports is Forbes’ breakdown of both it and Intel’s fortunes. It claims that after pulling back a few percent of market share in 2017 and 2018, AMD sat at 33% of the CPU market, as of December 2019. That’s impressive. But it’s still a long way from that coveted 40% figure that’s being touted.

None of this should take away from the fact that AMD is surging in the wake of its own successes, and Intel’s repeated failings over the past few years. In PassMark’s own data set, AMD hasn’t been doing this well since 2007, and as other sources show, its market share is rising. If Intel’s underwhelming Comet Lake leaks are anything to go by, that’s likely continue into the future.

But Intel maintains a dominant hold on the market and the global mindshare. It’s true that enthusiasts and those most tuned in to the latest and greatest technology are flocking to AMD Ryzen processors — and with good reason — but those who have always used Intel, or are upgrading older systems are not guaranteed to switch based on reviews and stats alone. Intel has been on the top of the pile for a long time, and it’s going to take more months and years of competition for AMD to claw its way closer to market parity.

It’s getting there. But it’s not at 40%. Not yet.