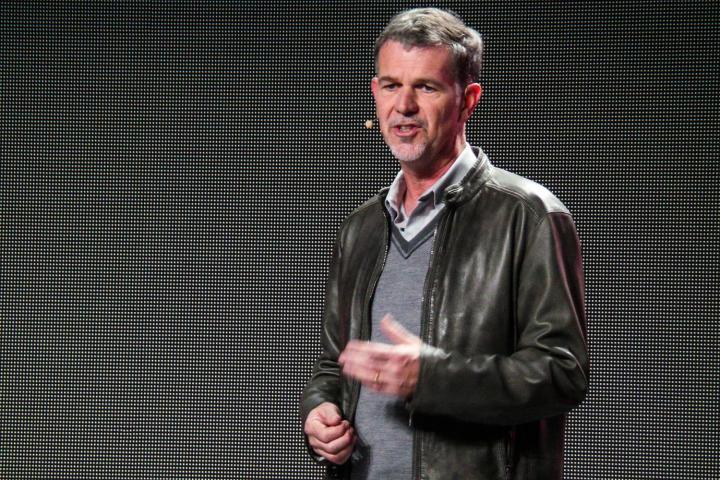

That’s the umbrella term used to describe on-demand streaming apps that allow users to watch TV whenever and wherever they want. Speaking at a New York Times conference Monday, Hastings said he sees the strength of these apps — or lack thereof — as a key for content providers to compete with Netflix, and other streaming services in the ever-changing video landscape.

As reported by Re/Code, Hastings isn’t too worried about giving away secrets to the competition simply because he doesn’t think those companies will be able to pull it off. Speaking about Time Warner Inc. CEO Jeff Bewkes (whom Hastings credits with pioneering the TV Everywhere concept) and other execs like Fox’s Rupert Murdoch, the Netflix chief laid out a theoretical plan for success in competing with his own company.

“The challenge in the industry is that it’s very fragmented between the cable networks and the distributors, and so it’s really tough to work well together, to extend the ecosystem,” Hastings said. In other words, the companies that make TV shows and movies haven’t figured out a good way to license their content to multiple distributors, including cable companies and satellite providers, as required to provide a congruent viewing experience on TV Everywhere apps. Comcast has Xfinity TV Go, Cox has TV Connect, DirecTV has its own branded app, and so on.

“We’ve always been most scared of TV Everywhere as the fundamental threat. That is, you get all of this incredible content that the ecosystem presents, now on demand, for your same $80 a month. And yet the inability of that ecosystem to execute on that, for a variety of reasons, has been troubling.”

He has a point. After all, content providers like Time Warner Inc. (which owns HBO, Turner Broadcasting, and multiple other networks) have had “seven, eight years,” according to Hastings to get TV Everywhere right, and still haven’t been able to make a cohesive system work as an integral part of our everyday viewing habits. That has left the door wide open for Netflix, and for follow-up services like Amazon, and even the network-owned Hulu, to refine their offerings, and fill the void.

In the past, content providers have been satisfied with simply selling off their older movies and past seasons of TV shows for a quick infusion of cash. Netflix made its bones through a mix of intelligent negotiations, and its own investment in content — the company is expected to spend as much as $5 billion on content next year alone. Much of that cash will go right into the pockets of content creators like Disney, Viacom, 21st Century Fox, and others, who have been happy to take the money and run.

Bloomberg reported in September that content providers like Fox and others are starting to change their strategy, in part due to a recent scare on Wall Street in which the perceived shift from cable and satellite — still the largest source of revenue for content providers — scared investors into a heavy stock sell-off of Disney, Viacom, and others.

But the key to beating Netflix is also just a simple question of creating a unified system — one that’s easy to use for multiple users, across a variety of cable or satellite providers — while still figuring out a way to pull in advertising dollars. That’s something that’s much easier said than done, which is a big reason Hastings isn’t worried about spelling out the recipe for Netflix’s defeat.

“Now, some of the independents — HBO, Showtime — have done a much better job. Their business model is much more straightforward, because it’s subscription. So they’re leading the pack in terms of now getting out there and marketing to subscribe directly as a consumer,” Hastings continued. “But the big system has to figure out TV Everywhere to get relevant for the Internet.”

In the meantime, content providers have had trouble weaning themselves away from the rich infusions of easy money that comes from simply handing over licensing rights of their titles to Netflix, Amazon, and others. And for now, that gives Netflix the advantage. Still, while Netflix is working at a lightning pace to create its own content — from original series to feature films — for now, the streamer is still heavily dependent on the very content providers with which its competing.

And with the streamer’s plans to, quite literally, conquer the streaming world one country at a time, the somewhat uneasy peace the two sides have struck continues to be put to the test. That said, with the traditional TV structure looking to be intact for some time to come, the day of reckoning still appears to be a long way off.

In the meantime, content providers are looking to improve TV Everywhere one app at a time, thanks in part to the great red streaming menace. Just what their efforts will do to change the way we watch TV in the next few years is anybody’s guess, but for now, Hastings (and the rest of the company) isn’t sweating it.