Apple just announced that Apple Card users will be able to grow accumulated Daily Cash rewards by depositing the money into a savings account with high-yield rates from Goldman Sachs. This new feature will be rolling out in the coming months, so it is not immediately available.

Apple Card launched in 2019 as a partnership between Apple and Goldman Sachs. While you could get a premium, titanium card with no numbers or information on it (besides your name), the main focus of Apple Card was Apple Pay. The Apple Card lives in the Wallet app, where you can view your balance and transactions, make payments, view statements, and more.

The unique thing about Apple Card is the fact that you get Daily Cash, which is deposited into your Apple Cash account immediately, instead of waiting for your statement to close like with most other credit cards. The amount of cash you receive back depends on how you use your Apple Card: 3% cash back from Apple Store purchases and other select retailers, 2% through Apple Pay, and 1% for everything else.

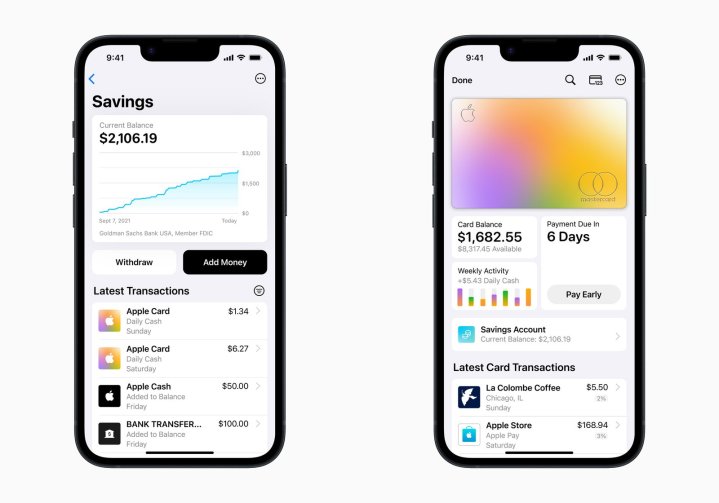

The current system for Daily Cash rewards is that it just gets deposited into your Apple Cash card. It sits there, with no way to grow, until you decide to use it or just transfer it back to your bank account. Apple’s new Savings account will be through Goldman Sachs, and if a user opts into it, Daily Cash rewards will automatically be deposited into it. There will be no fees, no minimum deposits, and no minimum balance requirements.

“Savings enables Apple Card users to grow their Daily Cash rewards over time, while also saving for the future,” said Jennifer Bailey, Apple’s vice president of Apple Pay and Apple Wallet. “Savings delivers even more value to users’ favorite Apple Card benefit — Daily Cash — while offering another easy-to-use tool designed to help users lead healthier financial lives.”

Like Apple Card, Savings will be set up and managed through the Wallet app. By default, the Savings account will mean that all future Daily Cash rewards are deposited into the savings account. However, users can also continue to have the money added to the Apple Cash card instead, and the destination can be changed at any time.

Apple’s Savings can also be used as a regular savings account, as users can deposit additional funds directly to it through a linked bank account, or even from the Apple Cash card balance. Money can also be withdrawn at any time with no fees.

However, while Apple says that this will be a “high-yield” savings account (HYSA), there is no mention of what the interest rate or rate range for the account will be. Currently, Goldman Sachs’ own “Marcus” savings accounts have a 2.15% annual percentage yield, and the industry standard is between 2% and 2.5% for HYSA.

If you’re an Apple Card user, this is exciting news. At the moment, it’s a little weird how Daily Cash is handled — it’ll just sit there on your Apple Cash card, so you can spend it through Apple Pay or use it toward paying off your Apple Card balance. Otherwise, you may just transfer that money back to your bank account. Apple’s Savings will let your money grow, while also keeping it in Apple’s ecosystem.

It’s important to note that Google tried to do something similar a few years ago with its “Plex” checking/savings accounts. However, this project was killed before it ever came to fruition. Given Apple’s success with Apple Card, it’s unlikely that Savings will be DOA, but without any information about interest rates, it’s all up in the air right now.