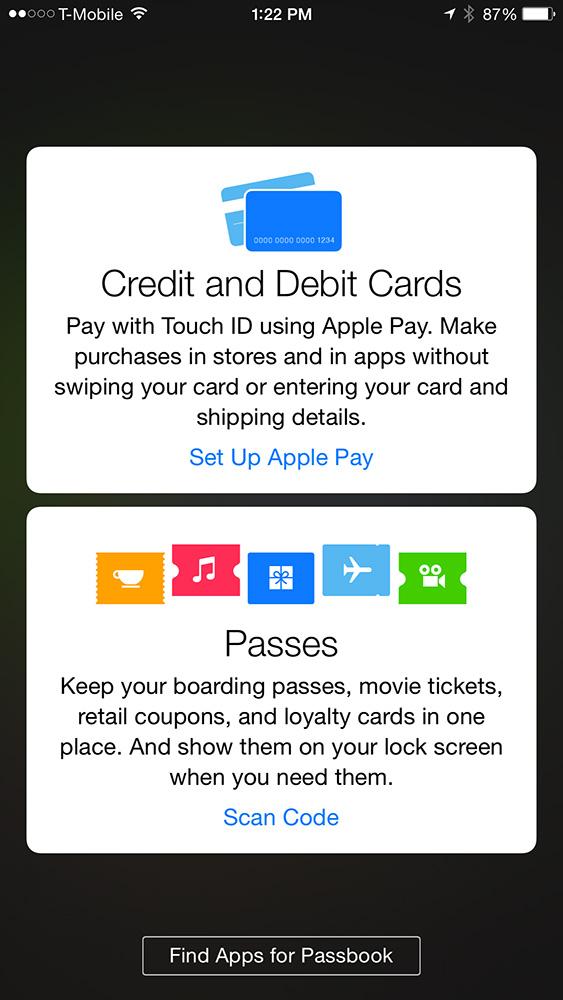

Like other mobile wallets before it, Apple Pay works at stores and cafes with NFC-enabled payment pads. It uses the same framework and the same technology that’s been around for years. what makes it different, is the ease of setup and use. Here’s how it works:

Apple Pay setup

Setting up a mobile wallet can be a true ordeal. Most competitors ask you for your routing number and other obscure information that you have to look up somewhere else. Either that, or they ask you for sensitive personal information like the last four digits of your social security card. That alone is enough to freak out many people. Apple Pay doesn’t ask for anything that you haven’t given the company already and makes setup much easier — Everything you need to set it up is on your credit or debit card.

(Note: Apple Pay is ONLY available on iPhone 6 and 6 Plus. No older iPhones)

- Download iOS 8.1 Update (it’s available now)

- Open the Passbook app

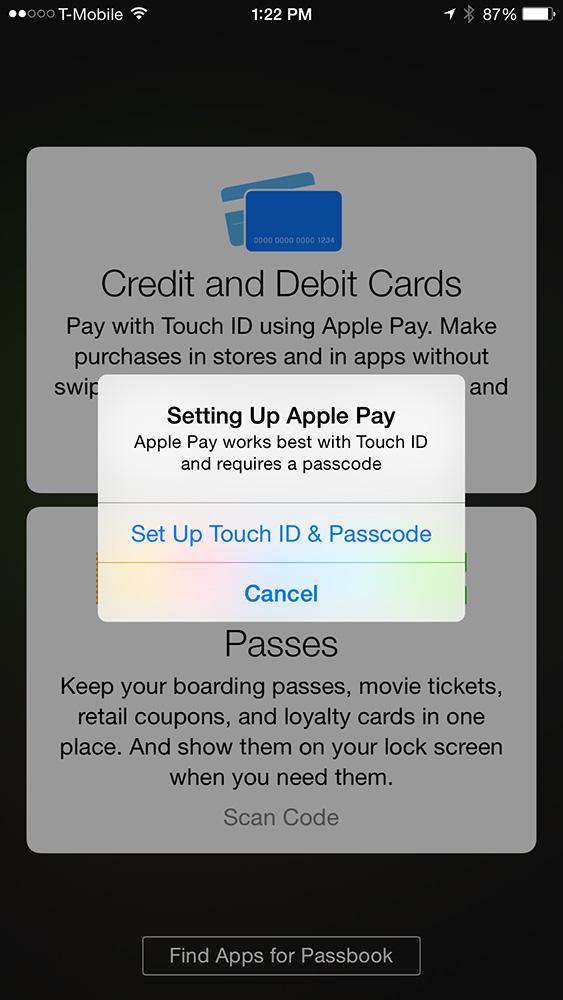

- Click on Set up Apple Pay (Make sure Touch ID is set up)

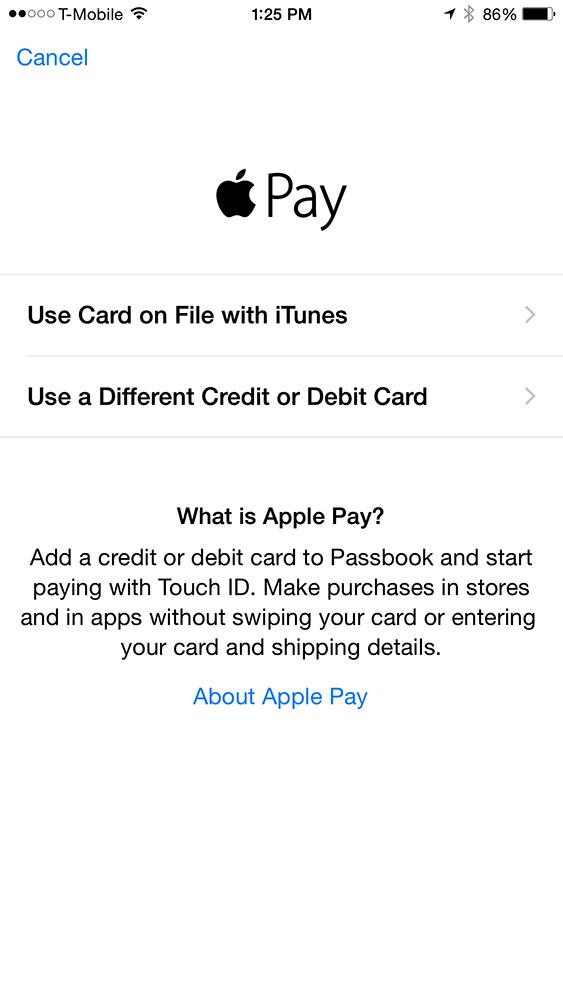

- A screen prompts you to either:

- Use card on file with iTunes

- Use a different debit or credit card

- If you use the card already file, you simply verify the card with the security code on the back.

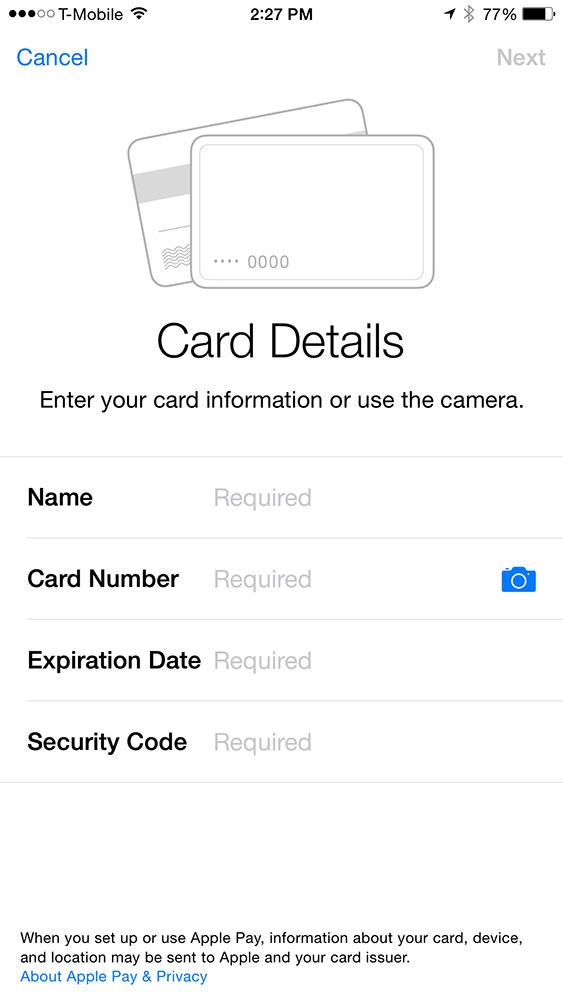

- If you add a new card, you can just scan the card details with your camera by touching the blue camera icon next to card number section

- If you don’t want to scan your card, you’ll be asked for the following info:

- Name

- Card Number

- Expiration date

- Security code

- If you don’t want to scan your card, you’ll be asked for the following info:

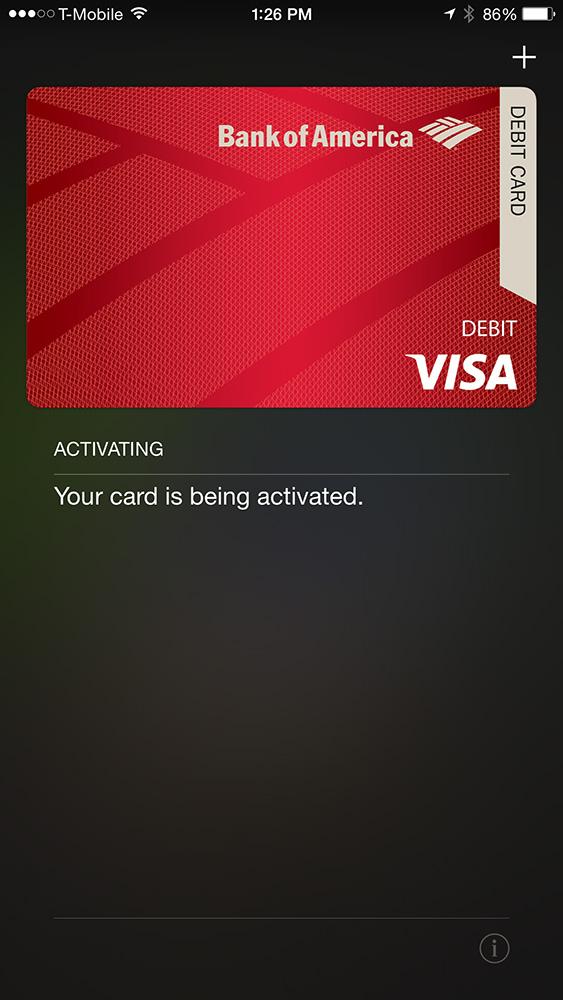

… And you’re done. Apple Pay will inform you that it’s activating your card with the bank’s permission and voila! You’re all set to tap and pay. I went through the entire process from start to finish in less than five minutes. I already had a card on file with iTunes, so setup for that card was easy. I added a second card just to test the camera scan feature and it worked perfectly. I didn’t have to enter any of my credentials, save the security code, which the camera can’t scan since it’s one the back of the card.

Apple Pay does not support all kinds of cards, though it does support Visa, MasterCard, and American Express. Many loyalty rewards cards and corporate cards don’t work with Apple Pay — yet. For example, our Deputy Editor at DT couldn’t add his old Michigan State University Federal Credit Union card or the company’s Amex corporate card to Apple Pay. Apple says it plans to add more partners and support more card types in the future, but if you use a smaller credit union or bank, it may not yet support the system.

Once your card is in the app, you can tap on the little info button to see the details of each card. You’ll have easy access to the mobile banking app, a fast link to contact your bank in case of a problem, the redacted card and Device Account Number, as well as the privacy policy and an option to remove the card. Your most recent transactions will also be listed.

Next page: Tap to pay works as well as advertised

Tap to pay is as fast and easy as advertised

Most mobile wallets face the same problem: They are just way to difficult to use. Many require you to wake your phone, open the app, select the card and then, finally tap to pay. After you tap, you then have to enter a PIN — just as you would with a normal credit card. For a mobile payment system to become popular, it also has to be easy to use and more importantly, faster than paying with your credit card.

My first experience with Apple Pay was nearly flawless. After waiting in line at Panera Bread for a few minutes, I approached the cashier, made my order, and got ready to use Apple Pay. The cashier told me my total and I held my phone above the payment pad. The Passbook app opened immediately and prompted me to place my fingerprint on the Touch ID sensor. I did so and as soon as my fingerprint was recognized, a check mark appeared in the fingerprint circle, telling me that I had finished paying. The system beeped, and the cashier handed me my receipt.

“That’s cool!” he said.

Paying with Apple Pay was undoubtedly fast and easy. It eliminated several steps in the payment process: I didn’t have to rummage around in my purse to find my wallet, pull out the right card, swipe it, or enter my PIN. My phone was already out because I routinely check it while I’m waiting in long lines — especially at lunch time — so I didn’t have to look for it. Most of the people I saw in line had their phones out, too, so it seems as though paying with our phones is a pretty logical idea.

The only part of the process that may cause trouble now and then is the fingerprint sensor. Sometimes it may read you wrong or you’ll accidentally use the wrong finger, but Apple Pay will let you try a second time, if it doesn’t work out right away.

It also works with select apps

A number of apps also work with Apple Pay, including Uber, Target, Panera Bread, OpenTable, Groupon, Spring, and more. Apple even added a special list of apps that let you buy things remotely with the service. I tried it out with a few different apps and it was very easy. Once I selected my items and went to check out, all I had to do was tap the black “Buy with Apple Pay” button and press my finger to Touch ID.

It still has a few limitations

Apple Pay makes a pretty persuasive case, but it does have its limitations. NFC-enabled checkouts are available at near;y enough stores and cafes to make Apple Pay universal. Some 220,000 locations do support Apple Pay at launch and the company plans to add many more. A new law will essentially force retailers to install NFC-enabled payment terminals by 2015 — lest liability for lost or stolen cards fall on their shoulders — and this should help speed up the adoption of Apple Pay. However, the feature only works on the new iPhones, so large-scale adoption is out of the question for now. Still, one could argue that Apple has just devised a killer app that will make users want to upgrade to the new iPhone.

As NFC-enabled terminals become more common and more retailers, banks, and card companies get onboard, Apple Pay will emerge as one of the leaders in the mobile payment space.