Investing can be intimidating, especially if you’re new to the game. But with the right tools and resources, you can make informed decisions and boost your earnings. We’ve got you covered whether you’re interested in stocks, mutual funds, or cryptocurrencies. The apps we’ve picked can be used on iOS and Android-based devices, including the iPhone 15, Galaxy S23, Pixel 8 Pro, and many more.

We’ve researched and tested different investment apps to help you separate the good from the bad, which you’ll find below with our picks for the best investment apps available in 2023.

If you’re looking for more great financial apps, see our picks for the best stock-trading apps and best personal finance apps, too!

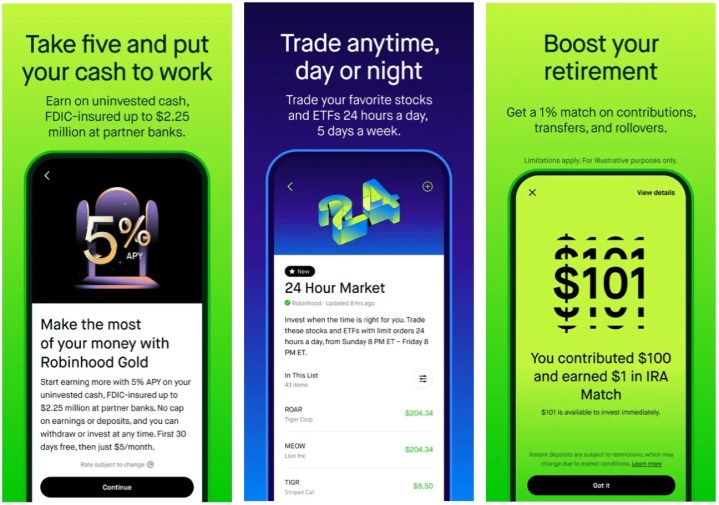

Robinhood

Investment platform allows users to trade various financial instruments such as stocks, ETFs, options, and cryptocurrency without any commission fee. This platform is designed for novice investors as it has a user-friendly interface, but people with any experience can use it.

One of the unique features of Robinhood is the fractional share purchasing option, which enables users to buy a portion of a share of stocks and ETFs. This makes it more accessible for users to invest in companies with high stock prices without purchasing a whole share, thus making it more cost-effective than many other investment platforms.

Moreover, Robinhood provides various educational resources — such as articles, videos, and more — to help users learn about investing. These resources cover many topics, including investment strategies, market trends, and risk management. This feature makes Robinhood an ideal platform for beginners who want to learn about investing or for experienced investors looking to expand their knowledge.

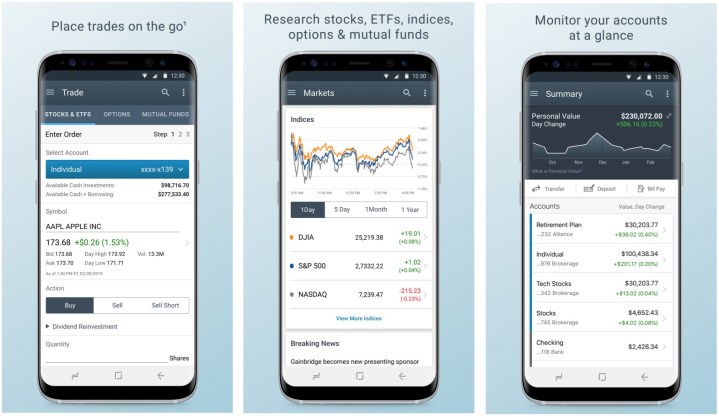

Schwab Mobile

Schwab Mobile is the ultimate investment solution that will take your financial management to the next level. Developed by Charles Schwab, a leading financial services firm, this comprehensive mobile investing platform has tools that enable you to manage your investments, track market trends, and make informed trading decisions.

One of the most impressive features of the Schwab Mobile app is that it provides real-time market data every trading day. With access to 24/7 stock quotes, news, and market commentary, you’ll always stay informed about the latest market developments, giving you a competitive edge in investing.

But that’s not all. The Schwab app allows you to monitor your investment portfolio’s performance, track asset allocation, and review transaction history to stay on top of your finances and make well-informed decisions. You can even create personalized watchlists to track stocks of interest and set up alerts to receive notifications about price movements or news events.

And when it comes to research and analysis tools, Schwab offers some of the best in the business. With access to in-depth research reports, market analysis, and analyst recommendations, you’ll have all the information you need to make smart investment decisions.

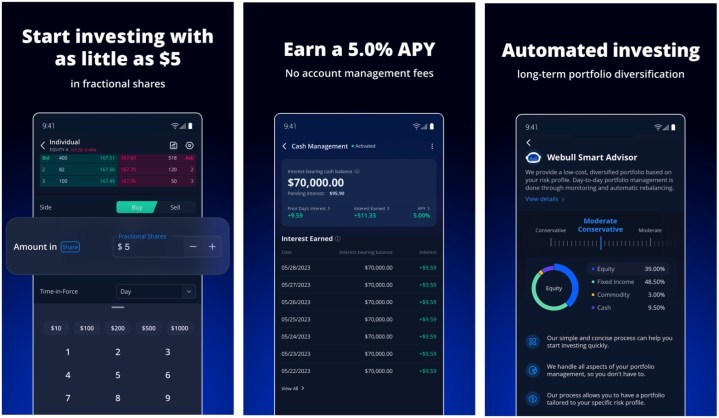

Webull

Webull is an investment platform offering many investment products, including stocks, ETFs, options, and fractional shares. Besides its commission-free investment products, Webull’s advanced charting tools are also a significant advantage. The platform’s users can access detailed market data, including real-time quotes, advanced charts, and technical indicators. These tools make it easier to identify market trends and potential trading opportunities.

Moreover, Webull offers margin trading, allowing investors to borrow money to invest in securities. Margin trading is a high-risk investment strategy but can amplify returns on successful trades.

Webull provides a comprehensive and cost-effective investment platform for investors who want to take their investment game to the next level. Its advanced charting tools, commission-free investment products, and margin trading options make it an excellent choice for experienced and novice investors.

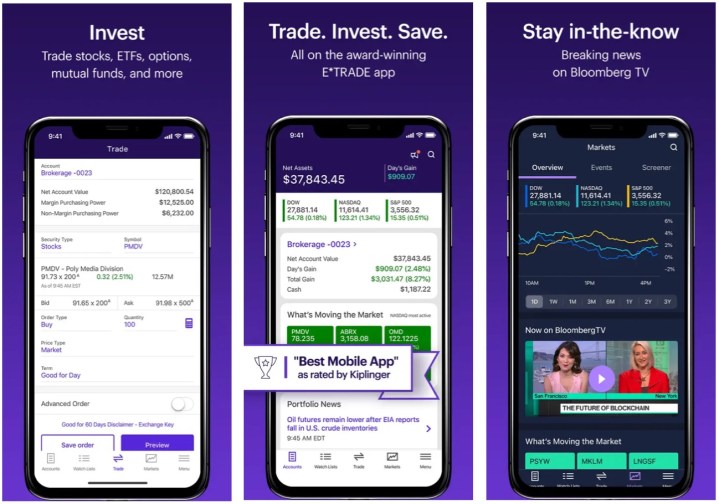

E*TRADE

Morgan Stanley’s E*Trade is a highly regarded financial services company offering a comprehensive electronic trading platform enabling individuals to trade various financial assets easily. E*Trade provides a vast selection of investment products and services, which include stocks, exchange-traded funds (ETFs), options, mutual funds, bonds, and more, catering to the diverse needs of investors.

One of the distinguishing features of E*Trade is its user-friendly platform, designed to make trading accessible to all. Additionally, the company offers a wide range of research tools and educational resources, such as market analysis, real-time data, and expert insights, enabling investors to make informed decisions. Whether you’re a seasoned investor or a beginner, E*Trade is an excellent platform to help you achieve your financial goals.

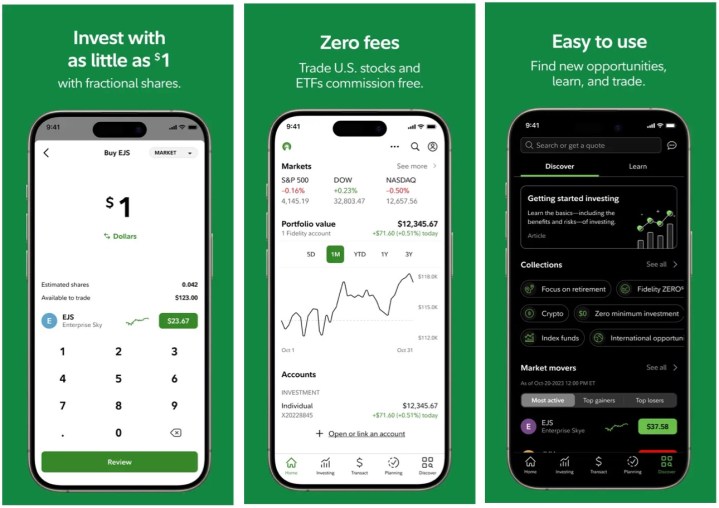

Fidelity Investments

Fidelity Investments offers a suite of apps that cater to different audiences. Among them is Fidelity Mobile, an all-in-one app that empowers you to take control of your investments, accounts, and finances. With Fidelity Mobile, you can trade stocks, ETFs, options, and mutual funds, transfer funds seamlessly, track your spending, and access timely insights and research to make informed decisions.

If you’re a first-time saver or a young investor, Fidelity Bloom is designed with you in mind. It offers an intuitive interface and a wealth of educational resources to help you learn the ropes of investing and financial management. You can set financial goals, track your spending, and easily save for the future.

For children and teenagers, there’s Fidelity Youth – a gamified app that makes learning about finance fun and engaging. With Fidelity Youth, your child will develop healthy financial habits as they earn virtual money through virtual tasks, learn about budgeting and saving, and explore different investment options.

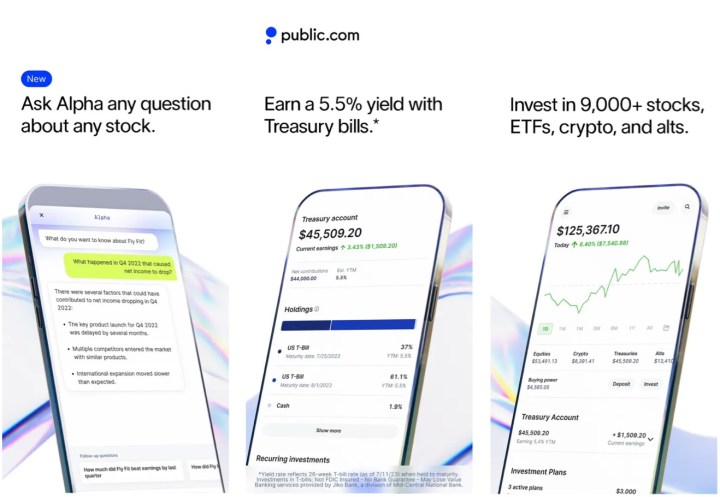

Public

Investing doesn’t have to be complicated or mundane. Enter Public.com – the social investing app that allows you to invest in various assets such as stocks, ETFs, cryptocurrencies, and alternative investments. Public is known for its intuitive interface and focus on social investing.

You’ll love the commission-free trades and the ability to purchase fractional shares, also available on other platforms. But Public goes above and beyond by offering thematic investing. You can invest in themed slices of curated stock baskets grouped around specific themes like healthcare, sustainability, or technology.

What also sets Public apart is its strong emphasis on social investing. You can follow other investors and see what they’re buying and selling. It’s like having a community of mentors at your fingertips, helping you make informed investment decisions. With Public.com, investing has never been more accessible, affordable, or social.

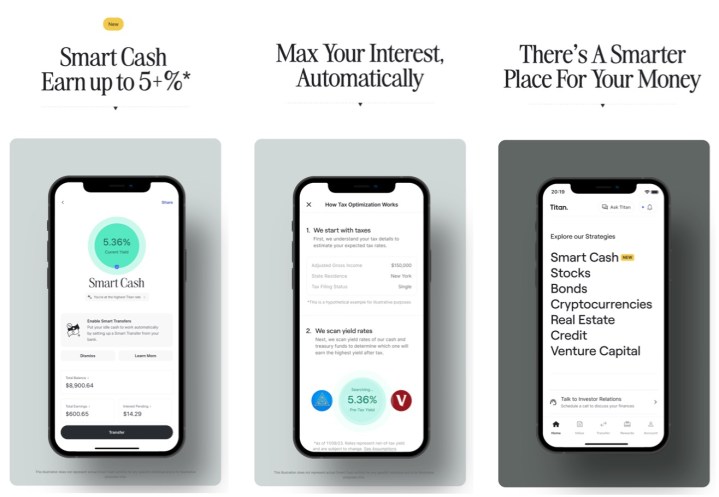

Titan

Titan is a trading platform that uses artificial intelligence (AI) to create intelligent trading strategies. The platform’s primary objective is to minimize risks and maximize customer profits. Titan takes a risk management approach by incorporating strategies such as setting stop-loss orders and adjusting positions based on market conditions to protect user’s capital.

In addition, Titan offers automated trading, which enables users to set up trading strategies and let the bot execute trades on their behalf. The platform also provides dashboard monitoring, multi-exchange support, and other useful features to assist users in their trading journey.

Betterment

Are you looking for a reliable mobile financial advisor who can help you invest, save, and manage your money? Look no further than the Betterment app. As a robo-advisor, Betterment uses cutting-edge algorithms to make investment decisions, so you don’t have to spend hours poring over charts and graphs. It’s the perfect solution for anyone new to investing or who doesn’t have the time or expertise to manage their own portfolios.

But that’s not all. Betterment also offers a range of features designed to help you reach your financial goals, including automated investing, goal planning, and retirement planning. With tax-loss harvesting, Betterment will automatically sell investments that have lost value to offset gains in other assets, reducing your taxes and putting more money back in your pocket.

Ellevest

If you’re looking for an alternative financial wellness platform, you might want to consider Ellevest. This service addresses women’s unique economic challenges, such as the gender pay gap, longer life expectancy, and career interruptions.

Ellevest offers a range of investment portfolios customized to women’s financial objectives and risk tolerance levels. These portfolios consider factors like women’s longer life expectancy and the importance of saving for retirement. Additionally, the platform provides numerous financial education resources, including videos, articles, and webinars, that cover a wide range of topics from investment basics to estate planning.

Finally, Ellevest is also known for its strong community of women who can support and encourage one another on their financial journeys.

Invstr

The Invstr app is designed to assist amateur investors in learning and investing in the stock market by providing practice, education, and a supportive community. The app offers a range of features suitable for users of all levels of experience, making it easy to get started with investing.

One such feature is fantasy finance, which enables users to simulate trading stocks using virtual money. This helps users understand the risks and rewards of investing without risking real money, making it an excellent learning tool.

Apart from fantasy finance, Invstr offers a variety of educational resources that include articles, videos, and webinars, covering a broad range of topics from investing basics to market analysis.

Moreover, Invstr has a solid and supportive community of users who can encourage and support each other throughout their investing journey.

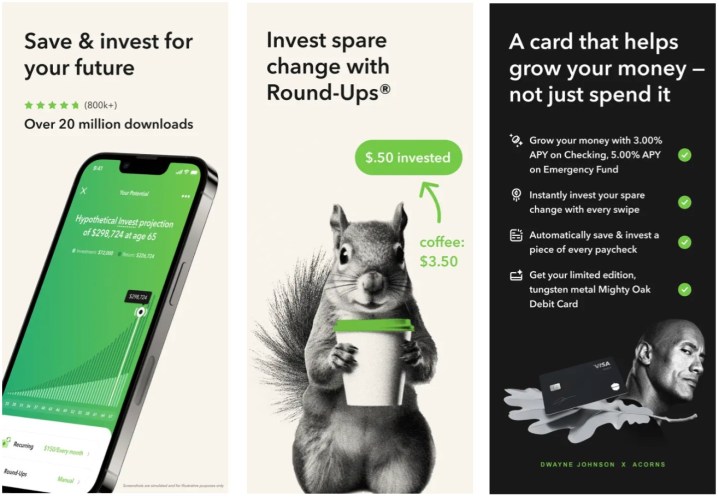

Acorns

If you’re new to investing and want to dip your toe in the water, Acorns might be the app you’re looking for. It’s a micro-investing app that allows you to invest your spare change automatically by rounding up purchases made through your linked bank account.

Getting started is simple and requires just a few minutes of your time. First, you need to link your bank card to the app. Once you’ve done that, Acorns will start rounding up your purchases to the nearest dollar and invest the difference. For example, if you purchase something for $3.50, Acorns will round up to $4.00 and invest the extra 50 cents.

The app is designed to be user-friendly and easy to navigate. You can set up recurring investments, monitor your portfolio, and withdraw your funds anytime. The app offers investment advice and guidance to help you make informed investment decisions.

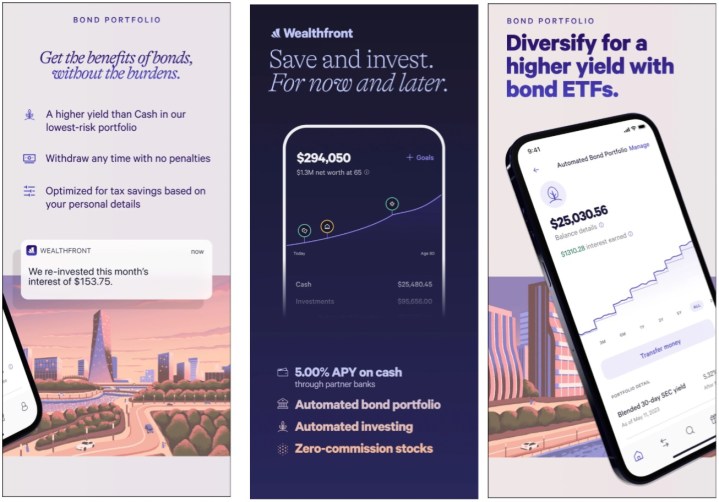

Weathfront

Wealthfront is a digital investment advisor offering various financial services, including automated investing and tax-loss harvesting. This makes it an excellent option for those who want a simple, hassle-free approach to investing.

With Wealthfront’s automated investing feature, the platform will invest your money automatically based on your financial goals and risk tolerance. This takes the guesswork out of investing and ensures that your money always works for you.

If you’re more hands-on, Wealthfront also allows you to customize your portfolio by including specific stocks or ETFs. This is ideal for those who have a particular interest in specific investment opportunities.

Wealthfront’s tax-loss harvesting feature is another great benefit of the platform. It automatically sells investments that have lost value to offset gains in other assets, thereby reducing your taxes. This is a great way to optimize investment returns and keep more money in your pocket.