If any part of running your small business requires driving, a good mileage tracker app is a must. Mileage trackers not only track miles, but they also log them into a tax-friendly format that you can use to augment your return. Some features are automatic, and using automated services in these apps will save you time and effort as you gather accurate expense and time report data, even if they do cost a little to use.

Mileage tracking apps use GPS to track your car’s motion from one location to another, and they often start recording distance when the wheels start moving and stop if you are in one place for a certain amount of time. Don’t expect 100% accuracy, though — it’s a good idea to simultaneously keep track of mileage yourself with your own odometer, just to make sure.

Each business needs different kinds of services from mileage trackers: Some need solid classifications, while others need to add more notes and reminders about each trip. That’s where many of the available apps differentiate themselves. Here are some of the highly rated mileage tracking options available as iOS apps and Android apps.

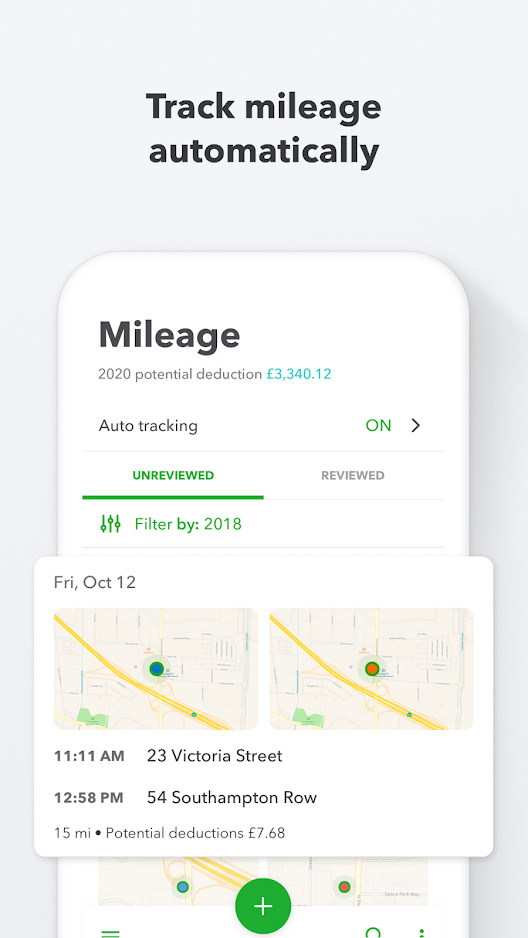

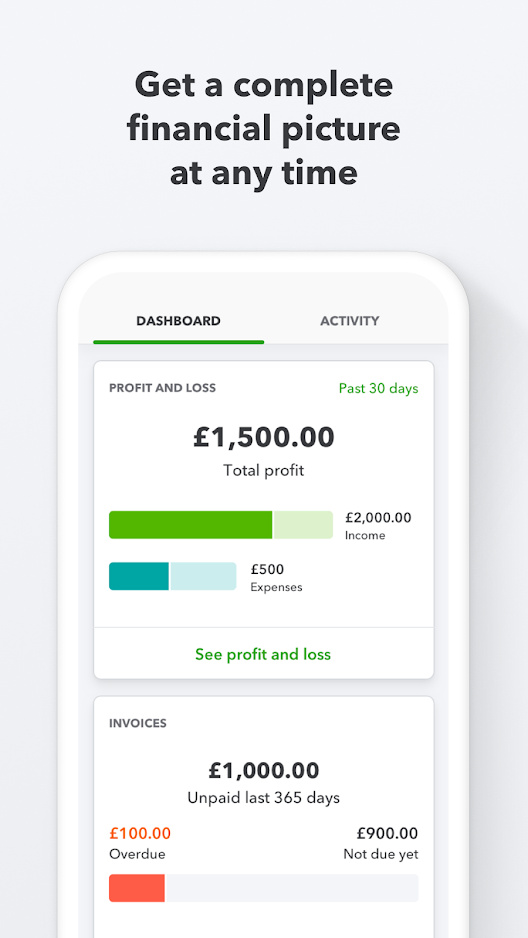

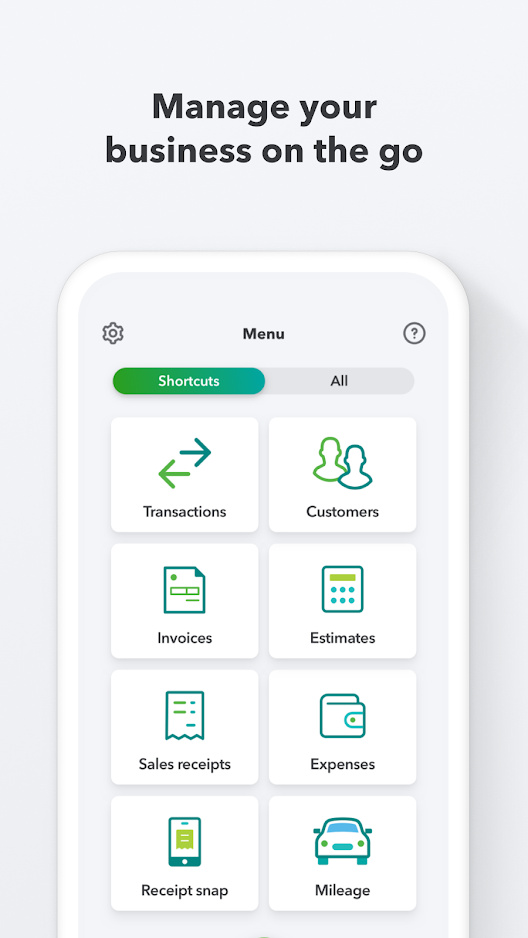

Quickbooks

With options to track your mileage, but also keep a close eye on all of your finances, QuickBooks is a complete package for small businesses or sole traders. The mileage tracking works by using your phone’s GPS, to help keep battery use down, and all your mileage data is saved and sorted into categories so you can read the data at a glance. But that’s not all you can expect from this app, and you can use it to invoice, keep track of expenses (with a receipt scanner or manual entry), and automatic tax calculations as well. You can access it from the app or web client, and you can try the app free for 30 days. Once the 30-day period is up, it’ll cost you a monthly subscription, starting from $5 per month.

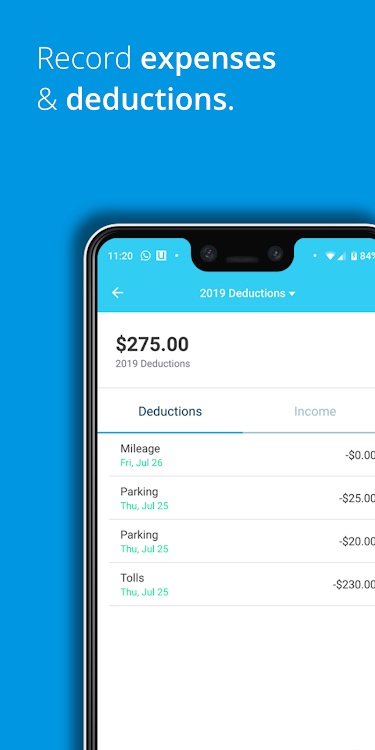

Stride

Stride, a free business expense and mileage tracker, helps you track your self-employed and 1099 business travel and expenses to save money on your tax bill. It’s great for driving-intensive vendors like Uber, couriers of all kinds, pet sitters, sales personnel, and many more business categories. It lets you import expenses from your bank, allows you to take photos of your business receipts, and helps you find money-saving tax deductions and write-offs. The app integrates with tax-filing software to make tax filing a breeze and helps you import your business expenses and upload receipts to make tax filing easier. It’s totally free of charge, too.

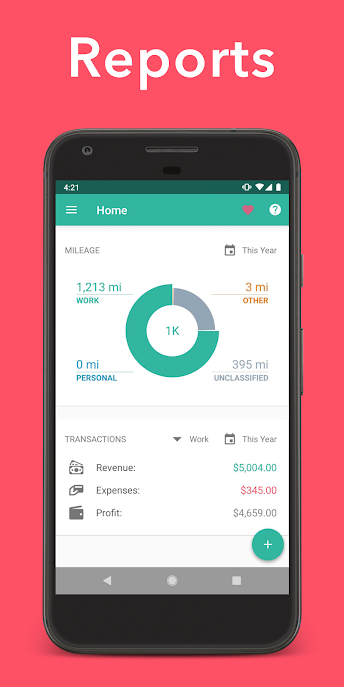

TripLog Mileage Tracker

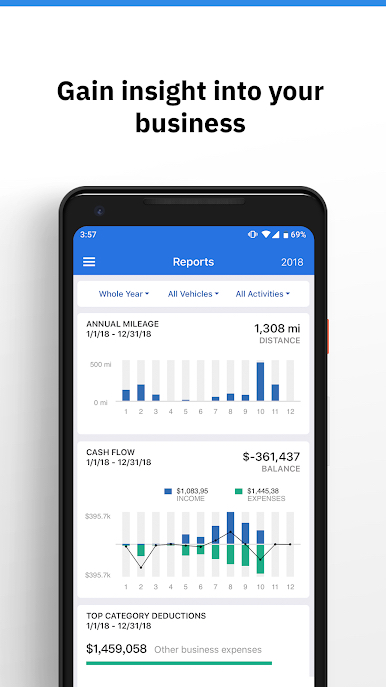

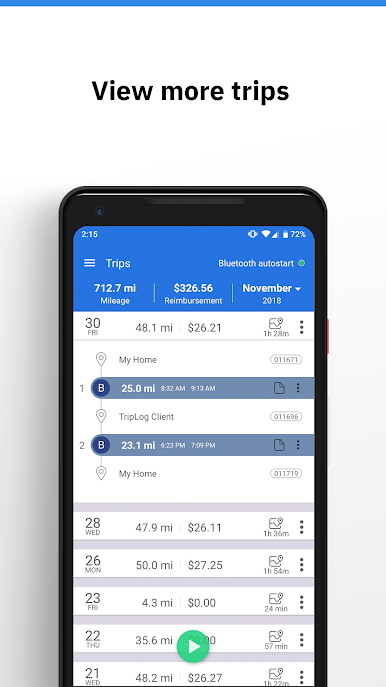

TripLog automatically tracks miles every time you drive your car or your fleet of vehicles. TripLog is designed for both personal and business expense reporting and automatically tracks deductible mileage, saving your business time and money and protecting you in case of an audit of your taxes. It also provides 100% IRS-compliant reporting that you can use with all major accounting platforms. TripLog is highly customizable: You can log miles for specific times of the day or set up the tracker for business and personal rides. TripLog can keep track of all vehicle and business expenses — fuel, parking, tolls, maintenance, insurance, lodging, meals — that you can cite as business deductions. TripLog also captures expense receipt photos and upload them to the cloud.

TripLog has been busy updating the app with various new features like a redesigned manual that includes GPS tracking, manual entry, and navigation; turn-by-turn navigation to any saved location; Siri voice commands; and a safety-tracking MagicTrip option for hard brake, rapid acceleration, and phone calls while driving. You now can pause your account and payment until a later date, too. The app supports businesses with mobile employees, car fleets, and truck fleets. A 30-day free trial is available, but it’ll cost you a subscription to keep going after that.

Everlance

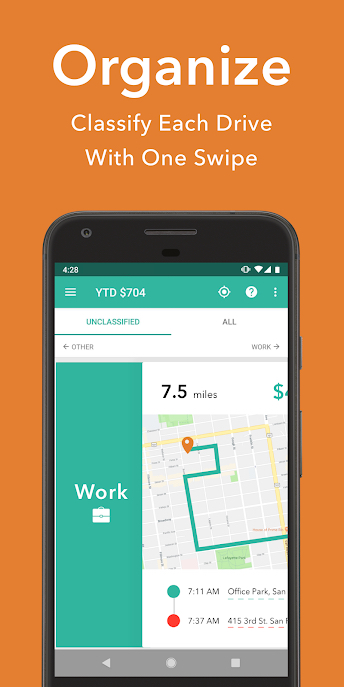

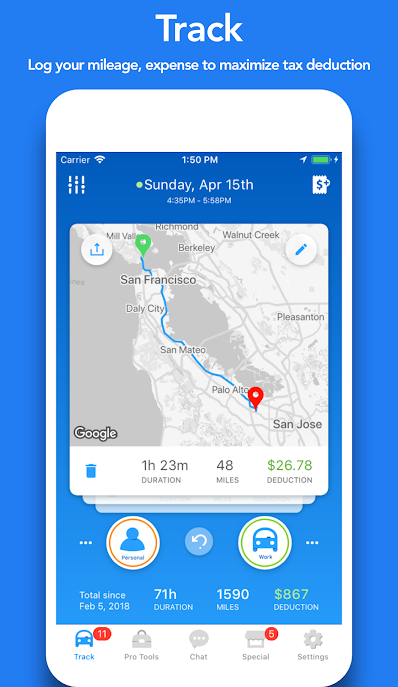

Everlance puts the free in freelance. It’s targeted at solopreneurs, real estate agents, photographers, self-employed people, general contractors, independent contractors, rideshare drivers, food delivery people, and employees who need to get reimbursed. Everlance promises to make tracking your mileage and generating receipts for tax deductions or reimbursement simple, easy, and free. Everlance tracks your mileage automatically using GPS — the app records your trips in the background, and you can manually swipe trips to the left or right to signify personal or business. Under the free plan, you can track an unlimited number of trips or receipts, or you can upgrade to Everlance Premium, and the app will automatically track your trips and transactions using credit card and bank integration. The app calculates business mileage, trip start/end time, and reimbursement value. It saves a GPS mileage receipt for each trip, which is backed up to the cloud. You can also upload your paper receipts for meals, supplies, and other expenses. The newest versions launch the Tax Vault savings account, which lets you automatically save money for taxes.

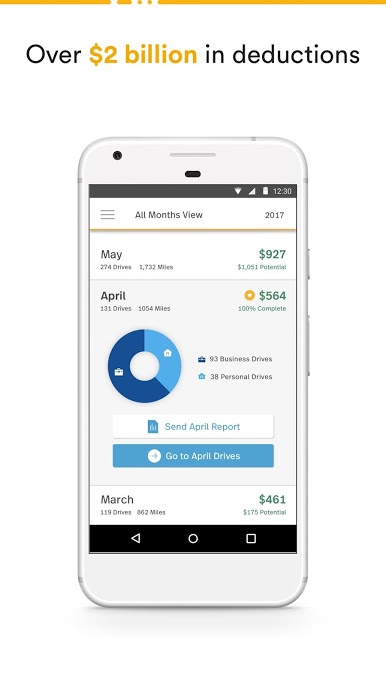

MileIQ

MileIQ is a free mileage tracking app that uses GPS-backed drive-detection technology to automatically log and track miles and calculate the value of your drives for taxes or reimbursements. The app helps you organize your drives for your business expenses and tax refunds and separates business miles from personal. It provides the reports needed to maximize your tax deductions and reimbursements. MileIQ automatically tracks your miles in the background — so you won’t have to manually log your miles or start and stop recording — and it will create a compliant mileage log for you. Mileage tracker records all trips down to fractions of a mile without consuming excessive battery power. Mileage reports provide information for the IRS and include details you need for your business expense reports. Expense reports are simple: Just export your mileage tracking data, or send yourself a spreadsheet with the data you need. New versions introduced Routes that facilitate GPS tracking of your drive onto the map and the ability to add vehicles with Bluetooth. For a complete record of all your drives, upgrade to MileIQ Premium for $6 per month or $60 per year.

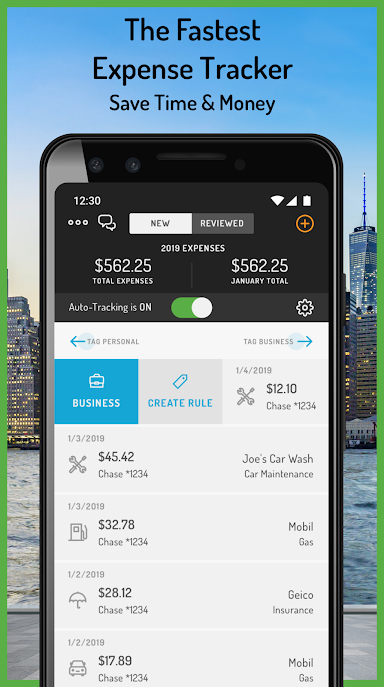

Hurdlr

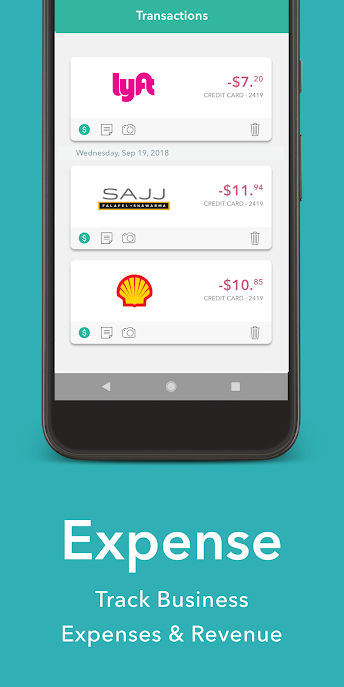

Hurdlr, a business expenses and mileage tracker targeted to small business owners, self-employed people, independent contractors, freelancers, Uber or Lyft drivers, couriers, and others, offers a compendium of services to let you easily capture receipts and create expense reports. Hurdlr connects with banks, Uber, FreshBooks, Square, Stripe, and PayPal to import your income and expenses automatically for easy income tax calculations. The app’s free version features expense, income tax, and semi-automatic mileage tracking. The premium version has better automation features with a detailed business tax tracker for quarterly tax accounting. Hurdlr’s IRS mileage tracking helps 1099 filers claim maximum tax deductions. The app lets you export detailed expense reports with receipts and send them via email or to a tax specialist. Hurdlr provides real-time, year-end, and quarterly tax estimates for independent contractors. Hurdlr is specifically designed to work without draining your battery, even with heavy usage.

Updates employ machine learning to save you money and time in helping you quickly find expenses that you can deduct based on CPA recommendations and other user behavior for your type of business. Artificial intelligence also learns your driving and spending behavior to make personalized suggestions to save you even more time and money. Updated reporting features let you view and export beautiful financial reports, with pro filters according to business and client base. You now can save favorite locations such as home, office, and client sites. Tax enhancement updates reflect current pandemic circumstances. Premium features cost $8 a month or $60 a year.

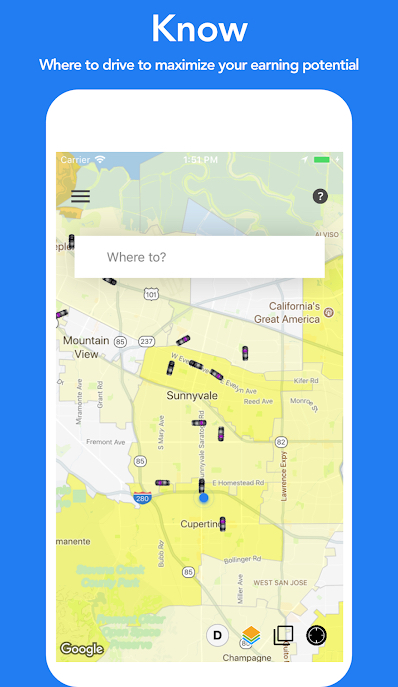

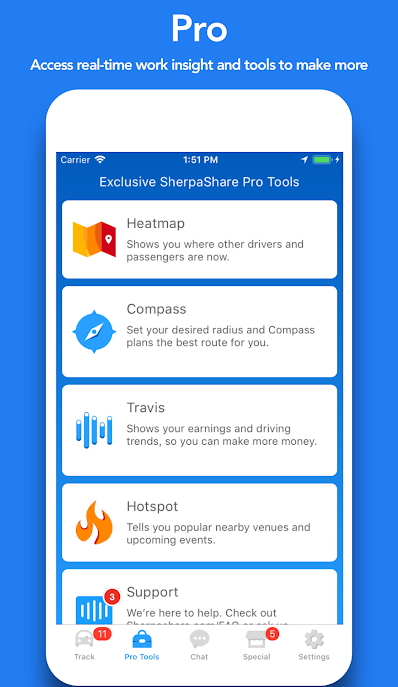

SherpaShare

SherpaShare bills itself as the ideal app for Uber or Lyft drivers, with a rideshare driver assistant that boosts earnings 30% or more. The app features automatic mileage tracking, expense tracking, and smart driver tools that help you plan the best routes. The app is for ridesharing drivers, delivery people, business travelers, and freelancers. It automatically tracks all mileage using your phone’s GPS without draining your battery. It also lets you classify your trips, track and categorize expenses, record trip details, back up information to the cloud, and connect with other drivers for real-time traffic conditions. SherpaShare lets you download a mileage tracking spreadsheet or printable mileage log so you can submit a professional looking tax return and expense report. The app’s advanced tracking technology is accurate, and always on, so you benefit from recorded total miles. Try the 14-day free trial.

MileWiz 2020

The MileWiz driving log uses your smartphone’s GPS to record your mileage as you drive. You can categorize trips the way you want or have the app do it for you. The IRS-compliant app can organize trips based on your working hours or the places you visit. MileWiz is ideal for the self-employed, small companies, as well as employees who use their personal vehicle for employment. You can log mileage, gas and parking expenditures, and toll prices independently to create invoices for your clients or employer.

MileWiz records your mileage automatically, even if you forget to start the app when you begin your trip. Visualizations of your drive route, distance, and value also appear on a map. Users can use a swipe gesture to categorize drives, adds places you often visit, configure working hours for auto-recording, add or merge drives, and track driving-related expenses. You can use the default categories that come with the app or design your own. The app also allows you to filter your data into easy-to-read reports. Use time, driver, vehicle, tags, or category to get to the information you need to bill your customers or take that tax write-off.

Users can sync all their data between devices or keep a cloud backup. MileWiz employs advanced algorithms that limit the app’s GPS usage to a minimum, helping conserve your smartphone’s battery.

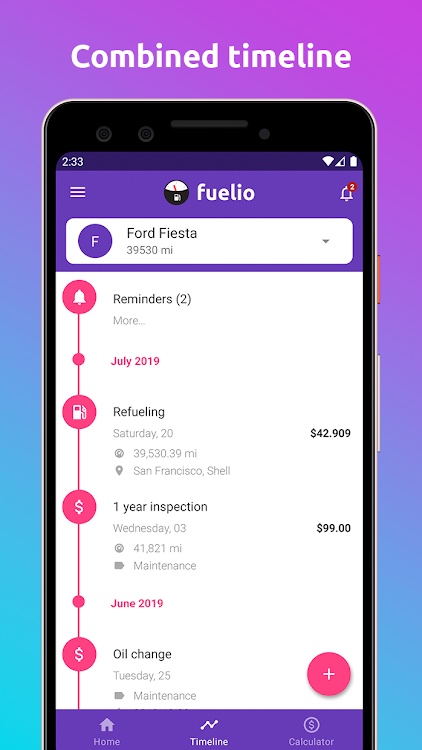

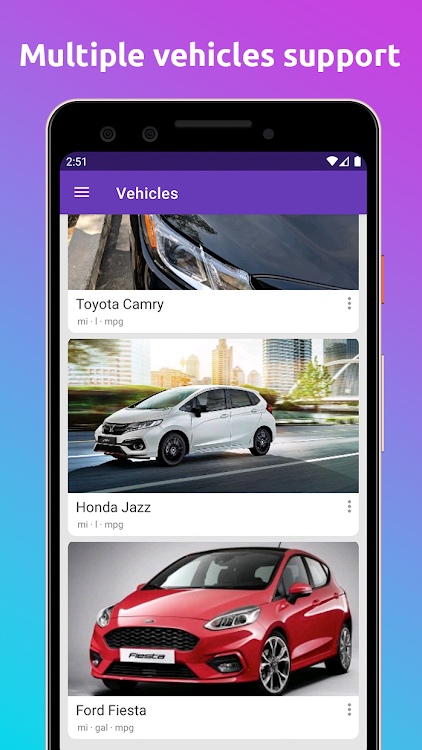

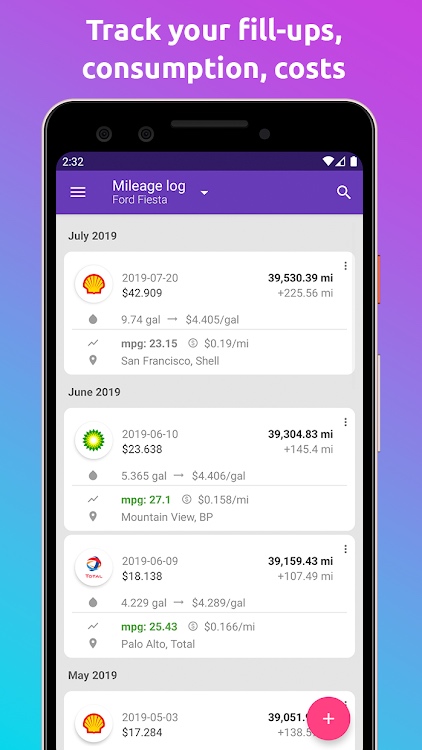

Fuelio

Fuelio is a versatile Android app that can track mileage, fuel economy, fuel costs, car expenses, and other maintenance costs. Its mileage log lets you track fill-ups, gas costs, fuel economy, partial fill-ups, and GPS location. This app does more than keep an eye on vehicle costs — it can also provide fleet management, letting you track multiple vehicles at once. Fuelio also provides gas price data in real-time, so you can make a more informed choice the next time you need to fill up. You can store Fuelio data locally or store it in the cloud, syncing with services like Dropbox and Google Drive so you can keep a backup to access anywhere.