Whether you want to repay your friend for fronting your bar tab or send some cash to your nephew for his birthday, a peer-to-peer money-transfer app comes in handy to facilitate the transaction. Money-transfer apps don’t require you to input your banking information. Find out how you can take advantage of these convenient payment options by reading about our top picks below.

If you have a small business, check out our picks for the best payment processors for smartphones.

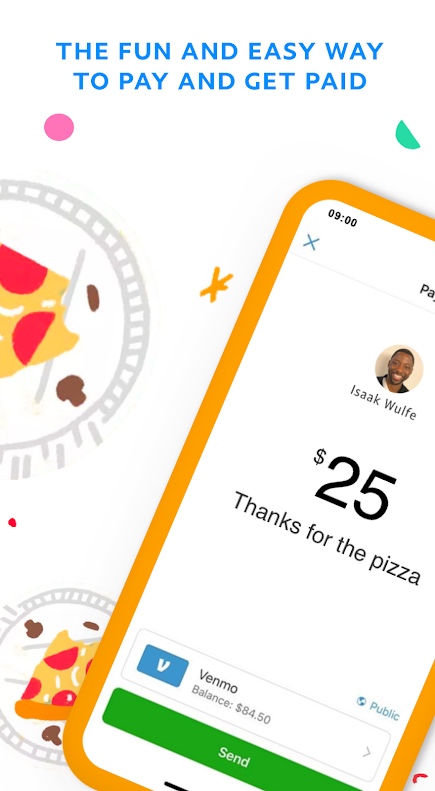

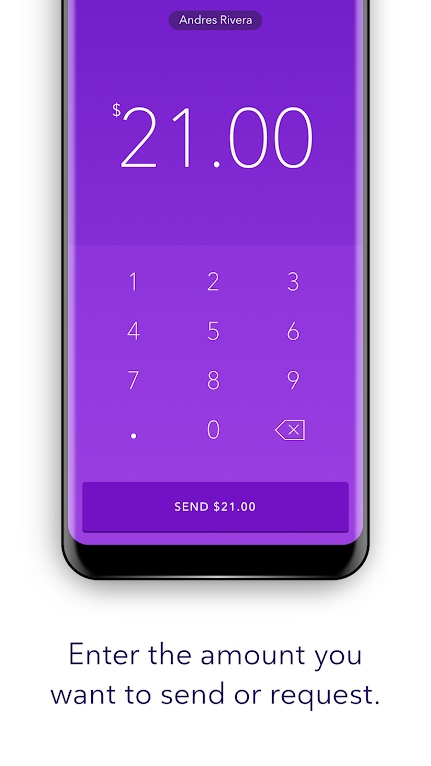

Venmo

The Venmo app has become so popular that the noun has become a verb. More than just — “Venmo me” — this app makes it incredibly easy to send and receive money to and from family and friends. Any payments made from your Venmo balance, most debit cards, or a bank account cost nothing to execute, and Venmo charges a 3% fee for credit cards. It boasts a bank-grade security system, so you won’t have to worry about shady hackers getting ahold of your financial information. The company also offers a Venmo Debit Card so you can use your Venmo balance everywhere Mastercard is accepted in the U.S., and even earn cash back rewards.

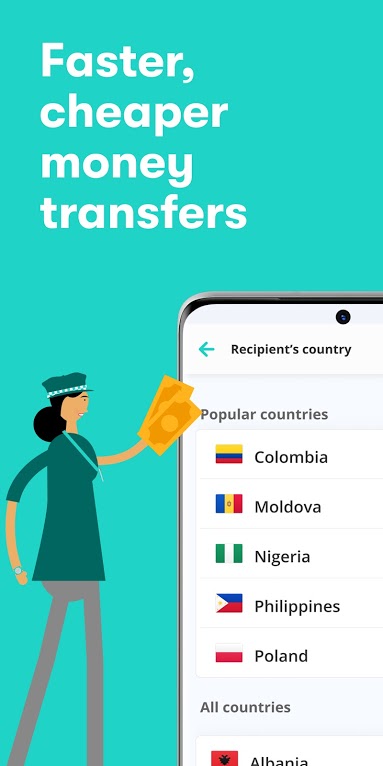

Azimo

If you have friends, family, or business contacts around the globe, Azimo offers fast, cheap money transfers anywhere in the world. Send funds from your phone to any bank account, mobile wallet, or more than 300,000 secure cash pickup locations. Your first two transfers are free of charge. Instant or one-hour transfers are operative in some 80 countries, and the service is available from 25 European countries to more than 200 countries and territories in eight languages.

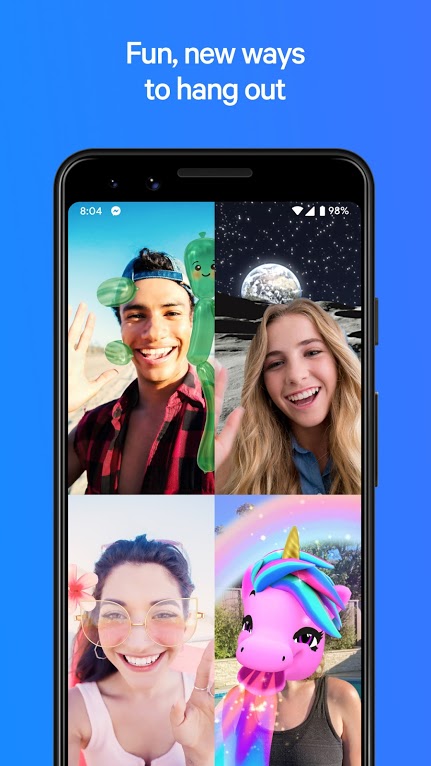

Facebook Messenger

Facebook Messenger allows anyone in the United States to send money via the app. While you’re chatting with someone, simply tap the Dollar Sign located above the keyboard, beside the tools for sharing photos and stickers. If you don’t see it, tap the Ellipsis on the right-hand side to bring up a list of additional options. Once you’ve set up your debit or credit card, just type the amount of money you want to send, then tap Pay in the top right corner. More recently, Messenger has rebuilt the app from the ground up for a faster and simpler operation. You can now message or call friends on Instagram right from the app and opt in to Vanish mode where previously viewed messages disappear after the chat ends.

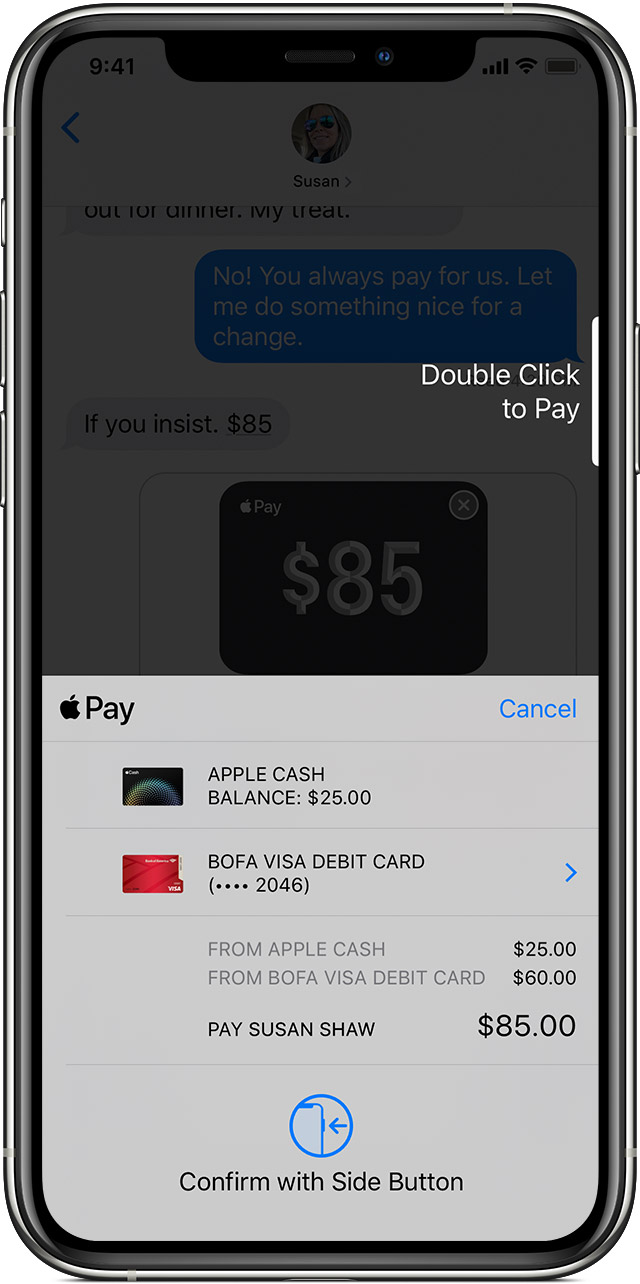

Apple Pay Cash

If you live in one of the countries that support Apple Pay — and you have an iPhone — then you’re in luck because there’s no need to install a third-party app if your contact also has an iPhone. In a conversation, simply tap the A symbol next to the camera icon, then tap Pay. Select the amount and tap Pay. You can also request an amount from one of your contacts. Send the message just like you would any other, and it will ask you to confirm using FaceID, Touch ID, or a passcode. Apple Pay Cash is also compatible with iMessage on your Apple Watch, and you can even use Siri to send cash. While the money is available in your Apple Pay balance immediately, it does take a few days for it to transfer to your bank account.

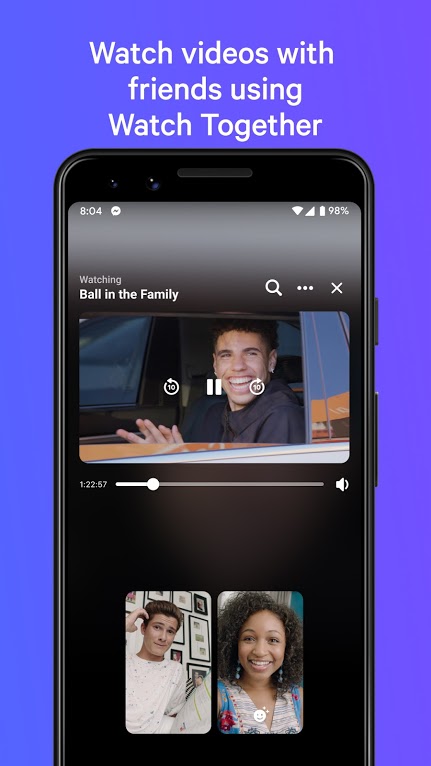

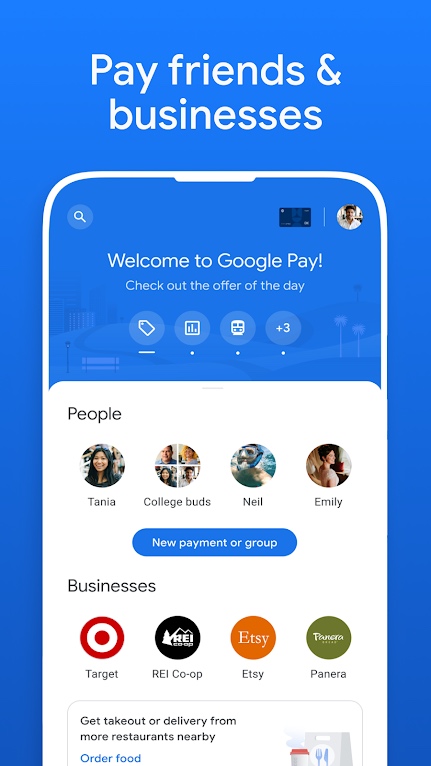

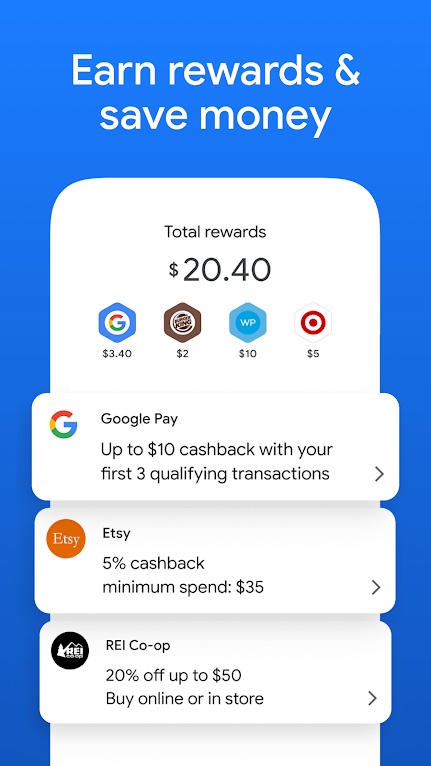

Google Pay

Google has launched an overhauled Google Pay, concentrating on personal and business relationships and targeted to sending and receiving money, tracking spending, financial insights, and rewards. Interface enhancements to the old app improve both performance and app experience. You can send or request money in private groups, plan, split, and make group payments from your phone. locate your friends for a quick payment. You can also view recent transactions on your home screen and find past purchases, loyalty cards, tickets, and offers in one place. You can link your bank account, Gmail, and Google Photos to search for additional transactions. If you have the old app installed, you’ll want to replace it with the new app linked below, by early 2021.

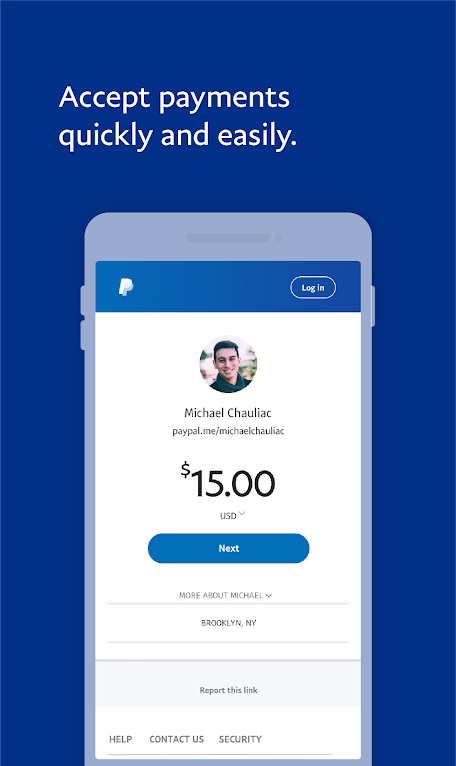

PayPal

PayPal is one of the original money transfer apps. Though receiving and sending funds can take a bit longer than some services, you can also use PayPal to pay for purchases at various establishments, and it’s capable of handling international transfers. It’s free for friends and family to send and receive money. Sellers can now opt in to receive tips from buyers on QR code purchases, with an option to configure predefined tip amounts, which the buyer can select or use a custom amount. U.S. users can now buy, hold, and sell Bitcoin and other cryptocurrencies in the app. PayPal now offers short-term installment plans at checkout available for U.S. customers. That’s all accompanied by an extra layer of security allowing you to confirm your identity without having to purchase anything.

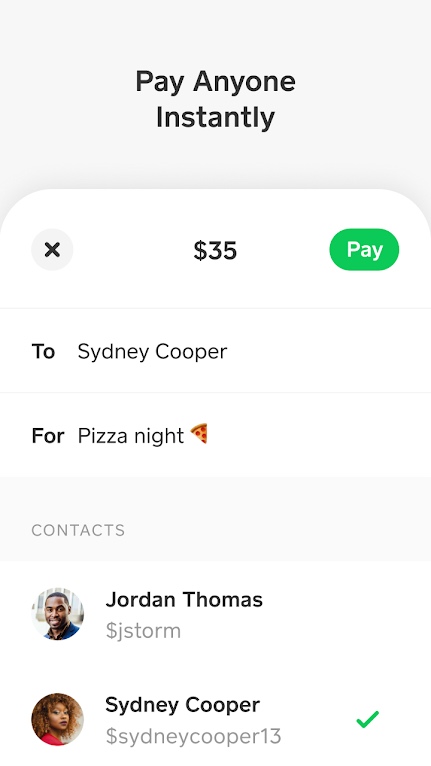

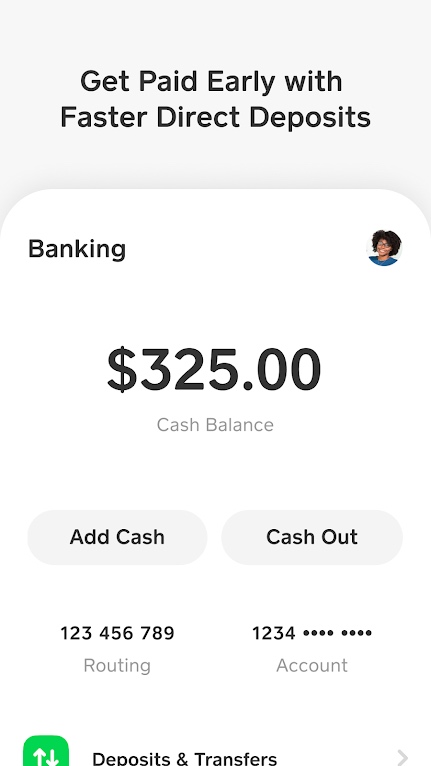

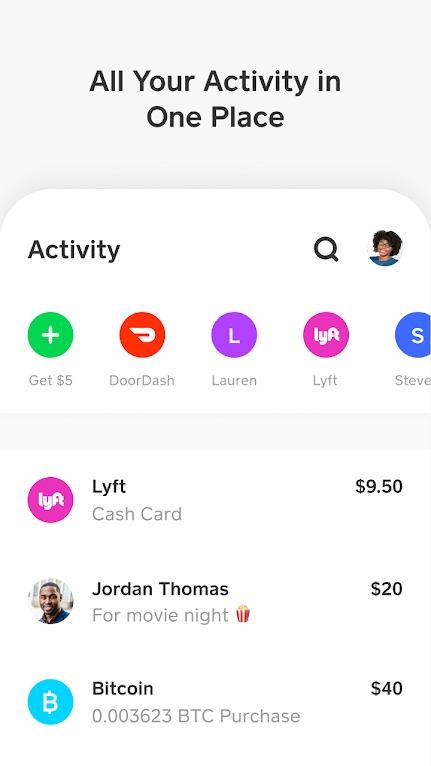

Square Cash

With a simple link to your debit card, Square Cash allows you to quickly send, receive, or request money from friends and family. Perhaps its most useful feature is how quickly money is deposited into your bank account once a transaction is complete. You can now see your daily gains or losses in your Investing tab and when you withdraw Bitcoin, you see the USD equivalent.

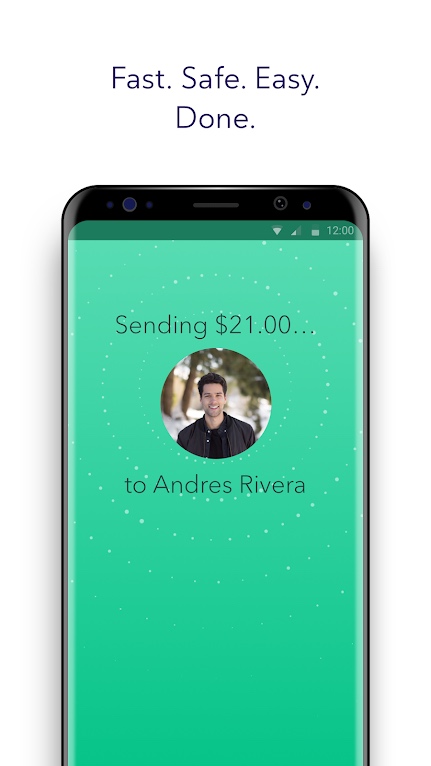

Zelle

Zelle has teamed up with banks and credit unions in the U.S. to provide a safe and easy way to transfer funds to friends and family. You must have a U.S. bank account to use the service. The money moves directly between bank accounts, so if your bank or credit union offers Zelle, you already have it in your mobile banking app or online banking. With your recipient’s email address or mobile phone number, you can exchange funds with no transaction fees.

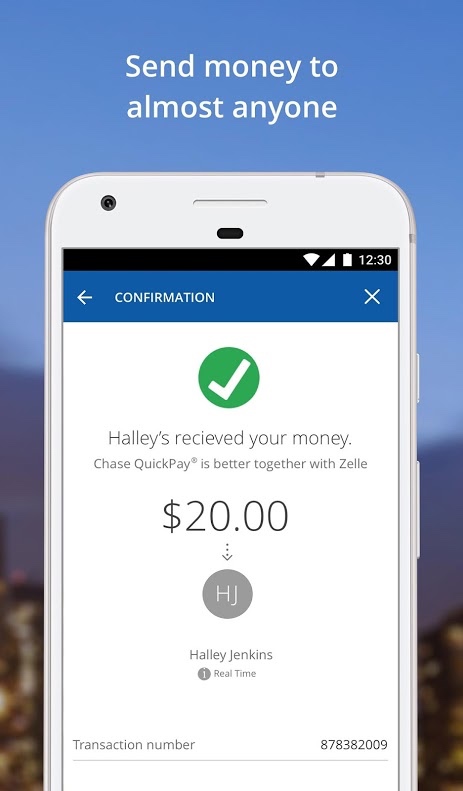

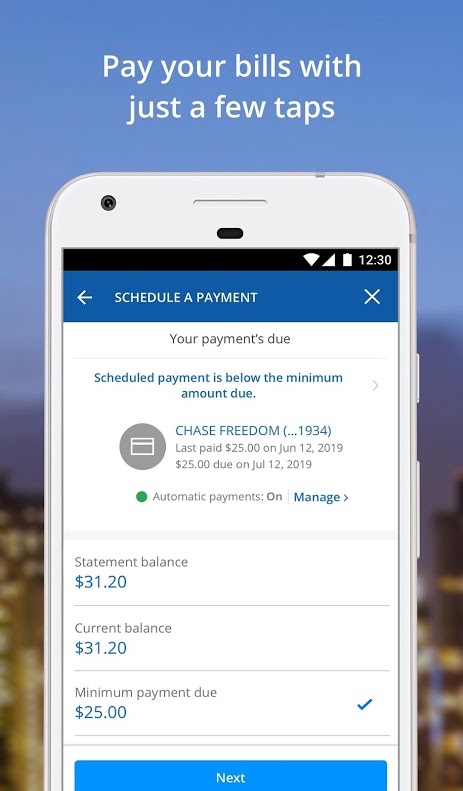

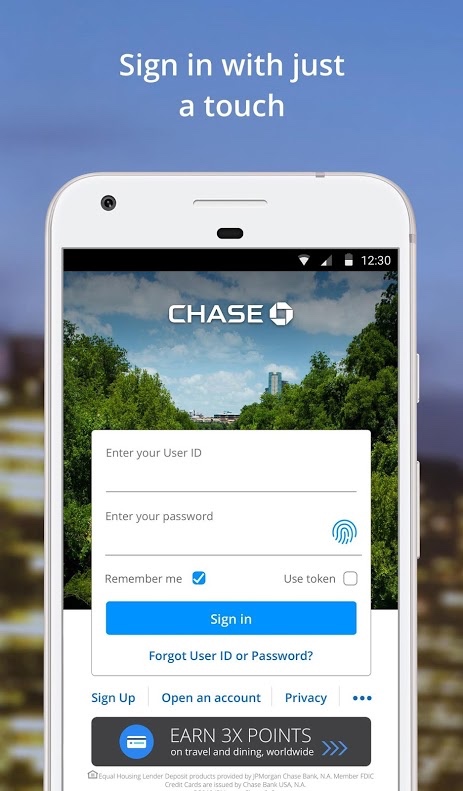

Chase QuickPay

Though Chase customers have access to a slew of banking options within the smartphone app, non-customers with valid email addresses also can send and receive money using the bank’s QuickPay feature. Recent updates let you earn statement credits by using Chase Offers with your eligible credit and debit cards. You can also get new Snapshot features, including monthly credit and debit card usage, cash flow, and category spending tracking. The app now lets you use Quick Actions to customize shortcuts to some of your account features, easily search your transactions, and review a summary of your spending. The Chase Mobile app also lets you add a memo or note to your credit card transaction details and manage your accounts with an enhanced home screen.

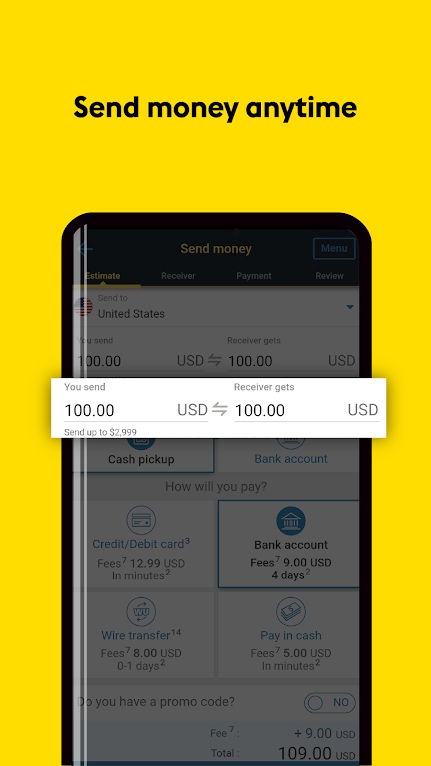

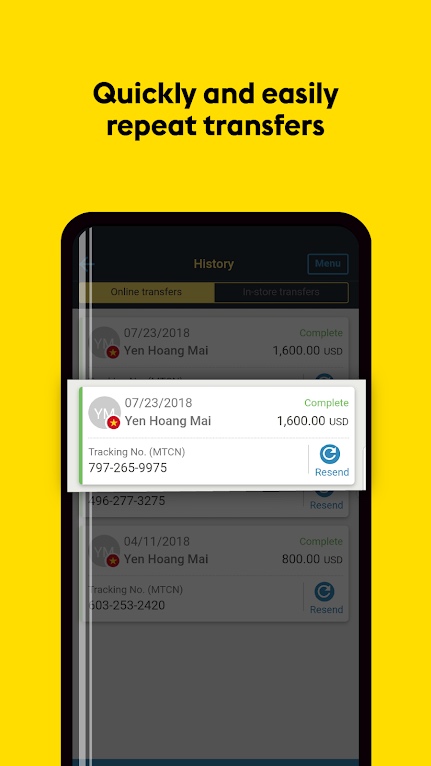

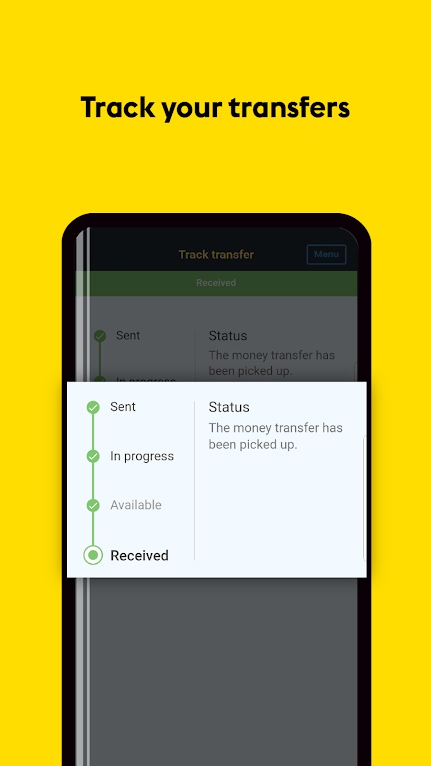

Western Union

The Western Union app isn’t the only application that allows people to move money between friends and family members. Not only that, but it also gives you the ability to transfer it to over 200 countries and territories. And if that doesn’t impress you, the Western Union app also tells you how much your money swaps should cost and presents you with all the Western Union branch listings.

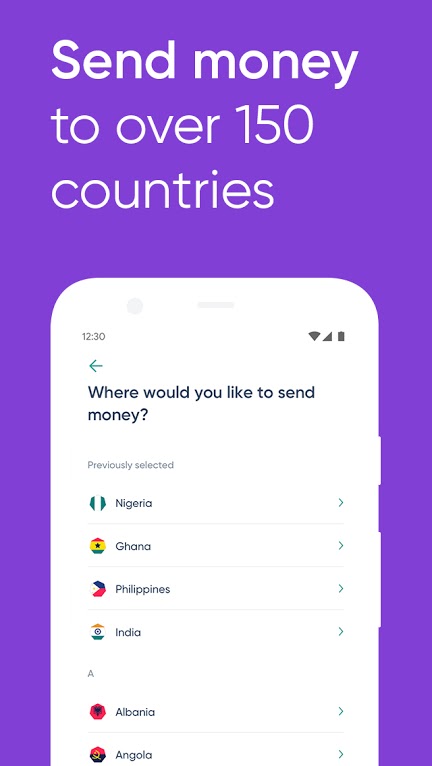

WorldRemit

You don’t have to worry when sending money through WorldRemit. You can safely, securely, and speedily transfer funds to friends and family in over 140 different countries with this convenient app. It’s incredibly user-friendly, and the exchange prices are relatively reasonable. You can also decide how the receiver should get the money, and they’ll receive SMS or email notifications when the exchange is finished.

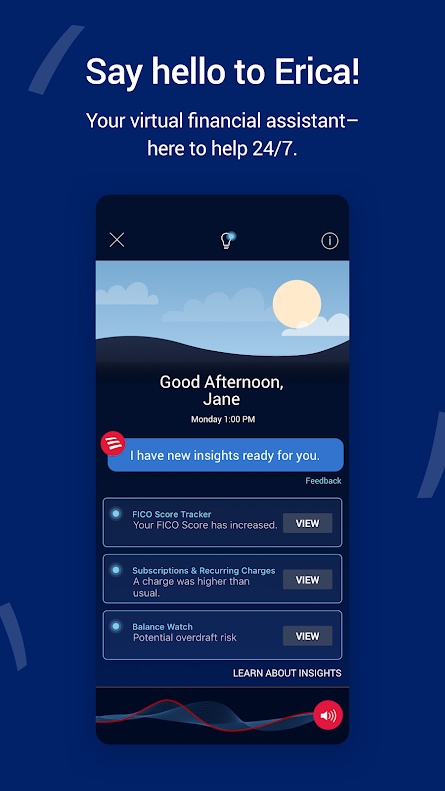

Bank of America

Bank of America’s smartphone app does more than just significantly reduce the amount of time you spend at a branch; it also lets you safely transfer and receive funds to or from any person (including non-customers) through a phone number or email address. The most current version even enables you to add a fun emoji icon to your note when you send or request payment with Zelle. You also receive real-time signals when you make a credit card purchase. Modern versions offer a special search bar with upgraded functionality, making the process more straightforward when you’re trying to access data and features.