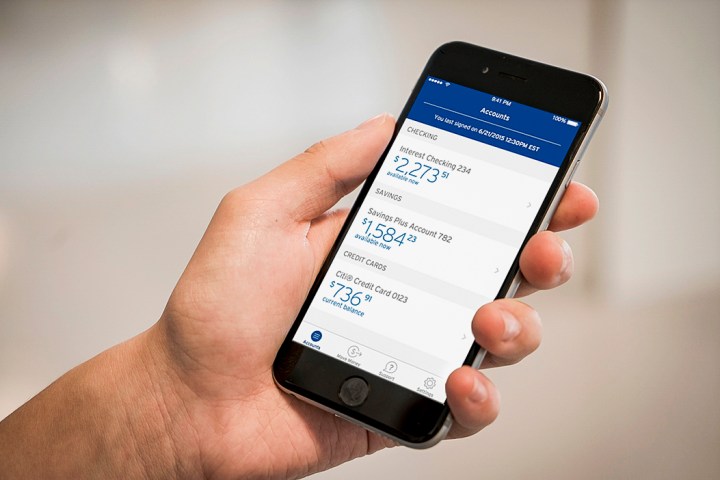

If you’re not using your smartphone to do banking by now, you’re missing out. Banking apps can send you instant fraud alerts, remind you to pay a bill, help you save for a vacation, and even locate the nearest ATM. They can, quite literally, save you time and money.

Most banks have offered customers dedicated apps for years. Today, those apps have evolved into digital Swiss Army knives of personal finance. Not only can you check balances and make payments, you can use many of them to analyze your budget and help you make financial decisions. And banks continue to add new features appealing to everyone from college students to entrepreneurs to new parents.

So without further ado, here are 10 super convenient things you can do with most modern banking apps.

Deposit Checks

Is that trip to the ATM really necessary? Not if you’re just depositing a check. Almost all bank apps will let you endorse a check and then use your smartphone’s camera to deposit it remotely. There are some restrictions, however. For example, limits range from Chase, which only allows you to deposit a maximum of $2,000 a day, to Alliant Credit Union, which allows you to deposit up to $50,000 worth of checks per day.

Control Your Debit Card

Guilty of overdrawing you account using a debit card? You can prevent this–and the associated fees–by using a bank app to set spending limits and send automatic notifications about your balance. Ally Bank offers debit card control, for example, and the Chase app lets you refill its debit card from your phone.

Send Travel Notices

Jetsetters know that every time you head out of the country you should alert credit card companies so they don’t block purchases abroad. Bank of America lets you apprise them of upcoming travel in seconds. With others you can add trip notifications months in advance on your app rather than enduring the arduous interactive voice menus over the phone (not to mention the danger of blurting out your card number in a crowded airport lounge). You can simply pick the dates you’ll be away, where you’ll be going, and which cards you’re going to use (credit and ATM/debit card). In most cases, the app will also remind you of any foreign transaction fees (usually 3 percent).

Pay Friends Back

There’s no need to go to an ATM to reimburse a friend, or for your friend to wait for their money. These days, most banking apps let you pay individuals directly, from one bank account to another. People don’t need to be customers of the same bank, but they do need to have access to the same third-party service. Many institutions, such as Citi and Chase, use Zelle. Recipients just have to sign up for it when they get their first payment.

Split the Check

One neat little trick available on a number of banking apps is direct access to Google Pay. Once you’ve done that, you can use Google Pay to split a dinner check, for example, with up to five people and get them all paid before you leave the restaurant. It’s quicker than Splitwise and more secure than Venmo.

Check Your Credit Score

The recent uptick in hack attacks and data breaches mean it’s probably a good idea to periodically check your financial health. Most banking apps — assuming you meet their minimum balance requirements — let you check your credit score for free from one of the three monitoring houses, such as TransUnion.

Report a Stolen or Lost Credit Card

Hopefully, it won’t happen to you very often (or ever), but if you do lose or have your cards stolen, the quickest, most pain-free way to close them is to do it via your banking app. If it is stolen, you can even order a new card. On the other hand, if you’re not sure whether you actually lost it or not, you can usually temporarily lock the card, and then unlock it when you discover, say, that it was underneath the sofa cushions the whole time. Finally, if you notice suspicious charges (or get a warning from your bank), you can dispute a transaction in seconds, rather going through the tortuous phone calls that are typically required.

Get a Mortgage

No more endless days of copying documents and filling in notarized forms — nowadays you can use some banking apps to apply for (and receive) a mortgage in minutes. TD’s app attendant, TD for Me, for example, even uses your location to pinpoint properties. If you’re near one of them, you can get a pre-approved mortgage offer (which can help you in a bidding war) based on your credit score and assets. At U.S. Bank they wanted to make it as easy as ordering a pizza, so even if you don’t get instant approval, the app will inform you of the status of application at each stage.

Start a Business

Got that entrepreneurial itch to launch your own company? Several banks allow you to apply for a small-business loan on your smartphone. Traditionally, applying for such a loan takes at least two weeks, with multiple visits to the bank and a whole lot of exchanging documents. Doing the application in-app can save days of downtime. U.S. Bank, for example, claims a customer can can complete a loan application in six and a half minutes — and in some cases even get the funds deposited in their account within seconds.

Improve Your Financial Health

Budgeting is an important part of maintaining fiscal well being. Many of the bigger bank apps let you easily analyze and assess your spending and saving habits. Many only offer a spending summary, like Citi’s app, which will show you at a glance you’re spending more on, say, your cable and Hulu accounts than you are on dinners out. But other apps, such as TD’s, go further with graphs depicting daily spending habits, what’s typical for you, and what changes you can make to meet savings goals.

Bonus Round

Your financial institution wants to be with you all the time, so many banks are are adding app features that seemingly have nothing to do with finance — like train schedules. With TD’s app, for example, you can get notifications and estimates of travel time, as well as alerts about delays on some public transit systems (depending on where you live). Why? Probably because of that old adage, “time is money.”