Millions of people in the U.S. apparently lend a small amount of money to a friend or relative and never get repaid, mostly due to the hassle of getting the person to send it. PayPal wants to help ease the struggle of asking someone to pay you back for small debts with a new peer-to-peer payments service called PayPal.Me.

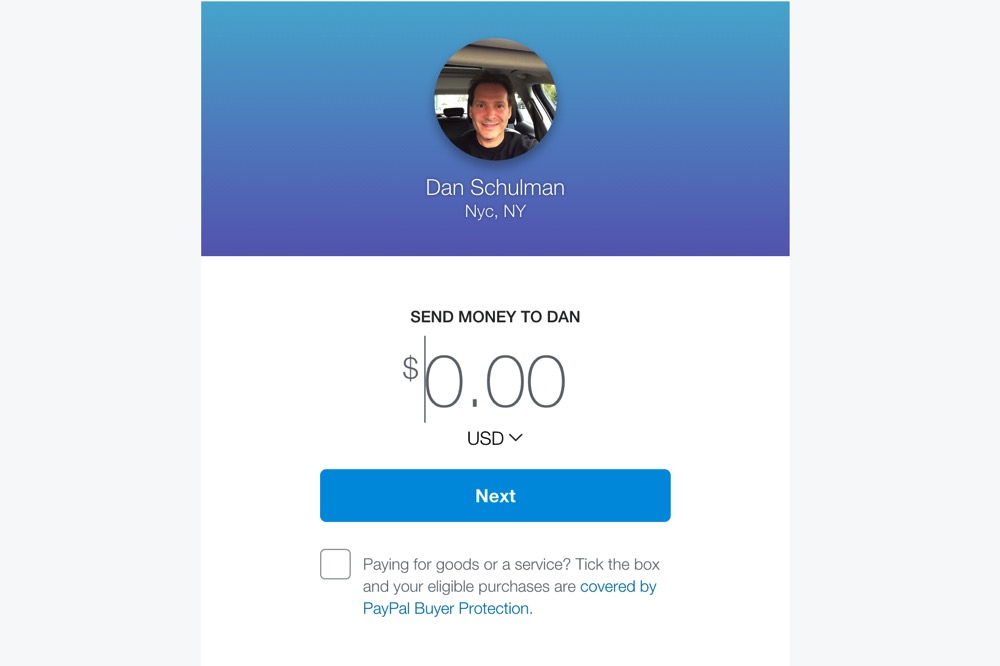

Every PayPal user can sign-up for a .me domain where the transfer will take place. You can set the amount they want back or allow the sender to choose the amount. The latter could be used for donations to creative projects. Lenders will be able to send a link and have the sender directly moved onto the page. This is a much easier way to ask for money than sending a sort code and account number or PayPal request to a friend.

PayPal is not the only company jumping on the friend lending bandwagon. Facebook announced a similar payments service in Messenger, Snapchat allows users to send small payments, and Square introduced $cashtag earlier this year.

The difference is with PayPal, millions already know it is a place to send money. More people have active accounts with money inside than they do on Facebook and Snapchat, despite the disparity in usage between PayPal and Facebook. PayPal still needs to win over millennials, somewhere Snapchat has the upper hand.

Seventy-three percent of people in the U.S. reportedly use digital payment services, and PayPal takes up a large chunk of that 73 percent.

The new payments service also takes on PayPal-owned Venmo, a shared payments service that is doing pretty well in the United States. It is odd that Venmo is still active while PayPal works on its own peer-to-peer service, although we might see more integration on the platform in the near future.