Most of us hate going to the bank and it looks like PayPal’s iPhone application has solved a pain point for anyone the needs to deposit a check without the hassle.

Most of us hate going to the bank and it looks like PayPal’s iPhone application has solved a pain point for anyone the needs to deposit a check without the hassle.

“We knew that this would be popular but we had no idea just how much pent up demand there was for a quick, easy way to deal with checks,” writes Senior Director of PayPal Mobile Laura Chambers on her blog post announcing the news.

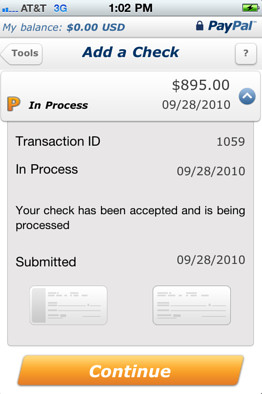

PayPal brought in mobile check capture in its latest version 2.7 of its iPhone application. Deposting a check via iPhone is as easy as clicking on the “Add Money From Checks” option in the Tools sections of the app. Users just need to take a picture of the check, front and back, and the funds will be automatically deposited into their PayPal account.

This service has been offered for at least a year by traditional banking institutions such as Chase, USAA and State Farm, all of which offer a similar application to quickly and easily deposit checks.

Handy as it may be, depositing check through PayPal could take time. The company requests that you hold onto the physical check for 15 days to ensure that it has cleared and been deposited.

Banks are turning more and more to encouraging customers to use self-service. Since the passage of the Check Clearing for the 21st Century Act of 2003, which gives banks the ability to exchange checks via electronic imagery, they have been looking fow ways to pass that on to consumers in a self-service model.

Furthermore, there is big cost savings to be had by allowing consumers more control over these kinds of operations. Research from the analyst firm Javelin Strategy and Research suggests that banks could save $8.3 billion in operating costs.