We’re getting closer every day to an entirely cashless society. While some folks may still carry around a few bucks for emergencies, electronic payments are accepted nearly everywhere, and as mobile wallets expand, even traditional credit and debit cards are starting to fall by the wayside.

That means many of us are past the days of tossing a few bills onto the table to pay our share of a restaurant tab or slipping our pal a couple of bucks to help them out. Now, even those things are more easily doable from our smartphones than our physical wallets.

There are a lot of apps you can use to send/receive money, the most popular ones being PayPal, Venmo, Cash App, and Apple Cash. But which one is the best, and which should you use? That’s what we’re here to find out.

| PayPal | Venmo | Cash App |

Apple Pay Cash | |

| Compatibility | Android, iOS, Web | Android, iOS, Web | Android, iOS, Web | iOS |

| Funding methods | Credit, debit, bank transfer | Credit, debit, bank transfer | Credit, debit, bank transfer | Debit |

| Credit fee | 2.90% + $0.30 | 3% | 3% | N/A |

| Debit fee | 2.90% + $0.30 | Free | Free | Free |

| International fee | 5.00% | N/A | N/A | N/A |

| Bank transfer fee | Free (1-3 business days)

1.75% (instant transfers) |

Free (1–3 business days)

1.75% (instant transfers) |

Free (1–3 business days)

1.75% (instant transfers) |

Free (1–3 business days)

1.5% (instant transfers) |

| Withdrawal limit | $25,000 | $5,000 | $1,000 without verification

Varies with verification (typically up to $7,500) |

$10,000 |

| Sending limit | $60,000 | $60,000 for transfers, $7,000 for purchases | $1,000 without verification

Varies with verification (typically up to $7,500) |

$10,000 |

PayPal

If you’ve been shopping online for long enough, chances are you already have a PayPal account — even if you haven’t used it in years. PayPal was arguably the original online money transfer service. It began in the fledgling days of the modern internet and became such a popular method for paying online that it was owned by eBay from 2002 to 2014. After being spun off into its own independent company again ten years ago, PayPal has focused on providing an alternative to traditional credit and debit cards for online shopping and allowing businesses and individuals to transfer money easily.

PayPal’s popularity makes it an ideal method for transferring money between friends and family simply because the folks in your circle are much more likely to also have PayPal accounts. However, PayPal also lets you send someone money even if they don’t; they’ll need to sign up for PayPal to receive the transfer, but they can do that from the notification email after you’ve sent the money (and your transfer will be refunded if they decline to do so).

To encourage folks to use its service for casual money transfers, PayPal also lets folks create custom paypal.me links that are easy to share and remember. Give someone your link, and they can simply click on it to be taken straight to a web page where they can send you money with only a few more clicks.

Technically, there are no fees for sending and receiving money in the U.S., but that depends on where you’re getting the money from. If you’ve linked your bank account, money can be sent from there with no additional fees; however, sending from a credit card through PayPal will cost you 2.9% of the amount you’re sending, plus a flat $0.30 fee on top of that, similar to the fees that merchants typically pay when you use your credit card in a store. PayPal also offers no-fee payments from Amex Send accounts and Visa+ transactions to Venmo Visa+-enabled digital wallets, although you’ll pay 1.75% when using Visa+ to send to a non-Venmo recipient, with a minimum fee of $0.25 and a maximum of $25.

Where PayPal gets exceptionally pricey is for international transactions. Send money anywhere outside the U.S., and you’ll be hit with a 5% surcharge, regardless of the payment method used. You’ll pay a minimum of $0.99, and it’s capped at $4.99, but it’s still pricey. On top of that, PayPal’s 4% foreign transaction fees — the amount they tack on top of the exchange rate — are among the worst of any money transfer service out there. In other words, if you want to send money to someone in Canada, the U.K., or anywhere else beyond the U.S. borders, you could end up paying 9% in total fees.

Getting money out of PayPal can also be costly if you’re in a hurry. Any money you receive remains in your PayPal account balance unless you transfer it out manually, and it’s good to plan ahead, as transfers to your U.S. bank account are free if you’re willing to wait up to three business days. However, instant transfers will incur a 1.75% fee, with a minimum of $0.25 and a maximum of $25, regardless of the total amount transferred. However, that could be worth it if you need fast access to your money, as instant transfers typically take less than 30 minutes to arrive in your bank account.

On the upside, PayPal has some of the most generous maximum transaction limits — at least in theory. Folks without PayPal accounts can send one-time payments of up to $4,000, but if you have a verified PayPal account (meaning you’ve added and confirmed your bank account or credit card), that limit increases to $60,000 in a single transaction, although PayPal notes that it “may limit that amount to 10,000.00 USD.”

PayPal offers a few other perks beyond personal money transfers, including a PayPal Debit card that lets you spend the funds in your account directly, along with Mastercard prepaid and credit cards. You can also pay directly from your PayPal balance at participating retailers by scanning a QR code with your phone.

Venmo

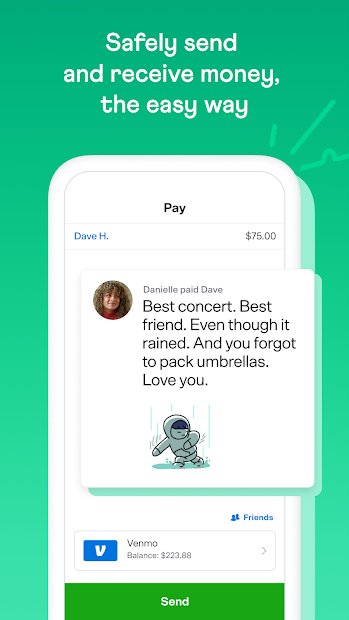

Part financial service and part social network, the PayPal-owned Venmo has become the go-to mobile payment provider for folks who regularly need to exchange smaller amounts of money with folks in their social circles. However, the social aspect also makes it one of the more unusual services available.

On the one hand, Venmo encourages you to build a friends list so you’ll have quick and easy access to those you want to share money with. That’s great, but it also encourages folks to make their transactions as public as a Facebook post. Thankfully, this isn’t mandatory, but you’ll have to pay attention when sending money to ensure you’re not broadcasting your financial affairs to the world.

Venmo started around 15 years ago as a way to help people split their bills and was focused solely on person-to-person payments for the first few years. However, after it got gobbled up in an acquisition by PayPal in 2013, it gradually shifted into a merchant platform and has more recently even shifted into cryptocurrencies. Today, any merchant that accepts PayPal can also accept Venmo.

Still, true to its roots, exchanging money with friends remains Venmo’s most popular feature, to the point where “Venmo me” has become a commonplace expression for asking someone to send you money. As with PayPal, you can carry a balance in your Venmo account, and anything you receive will sit there unless you spend it or transfer it.

Since PayPal owns Venmo, it shouldn’t be surprising that its fees are similar. Sending or spending money from a linked bank account or debit card is free, but using a credit card will cost you 3%. You can also send money using Visa Plus to PayPal digital wallets at no charge, but you’ll pay the same 1.75% fee PayPal charges for sending Visa Plus transactions to other digital wallets.

To get money out of your Venmo account, you can transfer it to a linked bank account in the usual 1–3 business days or use your Venmo Debit card to withdraw cash at an in-network ATM with no additional fees. Out-of-network ATM withdrawals will cost you a flat $2.50 transaction fee, while an instant 30-minute transfer to your bank account carries the same 1.75% surcharge as PayPal, capped at a maximum cost of $25.

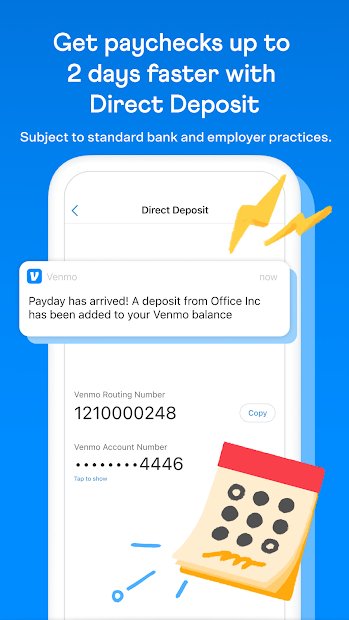

As a primarily personal payment service, Venmo offers several other ways to get money into your Venmo account. You can deposit checks by scanning them with the Venmo app on your phone, although you’ll pay a fee of 1% for payroll or government checks or 5% for other types of checks, with a minimum fee of $5 per item. You can also add cash using your Venmo Debit Card at retailers that offer this feature for a flat fee of $3.74. These are all pricier ways to go than simply transferring money from your bank account or setting up Direct Deposit, both of which are free, but at least the options are there if you need them. Funds added to your account through Direct Deposit or cashed checks are also covered by the Federal Deposit Insurance Corporation (FDIC) against bank failure, up to the usual limits.

Since Venmo is a U.S.-only service, you can’t send money internationally, although you may pay foreign transaction fees if you use Venmo to pay for goods and services when traveling abroad. Venmo has also increased its limits to match PayPal; once you verify your identity, you’ll be able to send up to $60,000 per week and spend up to $7,000 per week on purchases using Venmo in-store and online.

Cash App

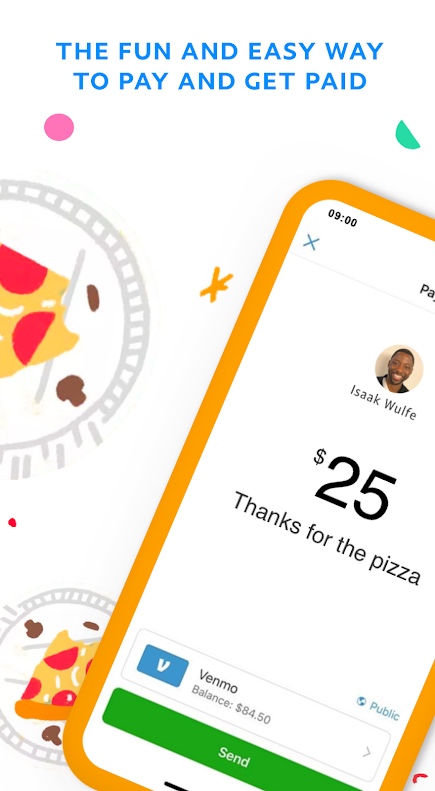

Originally launched as Square Cash in 2013, Cash App later rebranded to set itself apart from the point-of-sale payment processor, although it’s still owned by the same company, now known as Block. Square had already established itself with its mobile point-of-sale terminals that have become nearly ubiquitous in cafes, farmer’s markets, and other small merchants. With Cash App, the company intended to capitalize on that by extending its expertise into person-to-person payments and giving Venmo a run for its money.

Cash App has grown to rival both Venmo and PayPal as one of the biggest personal payment solutions in the U.S. thanks to its ease of use across multiple platforms. Cash App’s claim to fame is that you don’t need an account to send smaller amounts of money, but if you want to lift that cap, you can sign up in seconds with nothing more than a mobile number or email address and a debit card.

When setting up an account, you’ll be prompted to choose a unique “$Cashtag,” which is the handle that others will use to send you money. Like PayPal, Cash App also lets you give folks a “cash.app” link so they can send you money easily, but you don’t need to create one separately as it ends in your Cashtag, so it’s ready to go as soon as your account is set up.

While Cash App will encourage you to invite your friends when you sign up, that’s as far as the social features go. The mobile app is a refreshing beacon of simplicity that focuses on sending and receiving money with no superfluous bells and whistles. You also don’t need to leave any money you receive sitting around in your Cash App account, thanks to an Auto Cash Out feature that will send everything to your bank account right away.

Cash App’s fees are on par with Venmo’s, and it offers many of the same services. Sending and receiving money is free as long as it comes from a bank account or debit card; credit cards cost the usual 3%. Free transfers to a bank account take 1–3 days, with faster instant transfers available for an additional fee. However, Cash App may cost you less for those, since it quotes a 0.5% to 1.75% range, with the actual fee “disclosed at the time of the transaction.” You can also withdraw money at an ATM with a physical Cash App Card, with a per-transaction fee of $2.50. The Cash App Card can also be used to spend your balance like any other debit card, assuming you choose to leave money in your account instead of transferring it to your bank.

A non-verified Cash App account can be used to send up to $1,000 in a rolling 30-day period and can only hold a maximum balance of $1,000. After you verify your account, which requires providing your full name, date of birth, and social security number (SSN), those limits will be increased. Cash App doesn’t provide any specific information on these limits and implies that they may be set on a per-customer basis; however, some third-party reviews cite them as sending up to $7,500 per week and receiving an unlimited amount.

Apple Cash

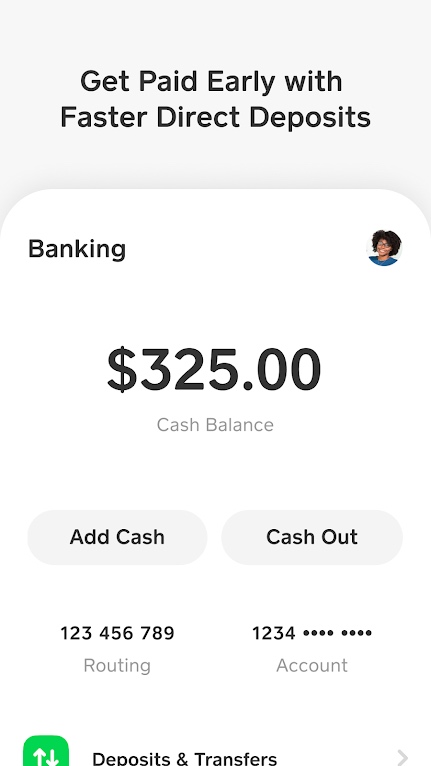

Although Google recently abandoned its person-to-person payment platform, Apple Cash is alive and well for those living in the company’s ecosystem. Apple’s foray into personal mobile payments began in 2017 as an extension of Apple Pay — in fact, the service was originally called “Apple Pay Cash” — and promised to make sharing money between iPhone users as easy as exchanging messages.

That was a pretty easy feat to accomplish since Apple owns all the pieces. Unsurprisingly, Apple Cash is tightly integrated into Apple’s iMessage platform, which means you can literally send someone money in an iMessage. You also request money in the same way. Even transfers initiated from Apple Wallet are sent through iMessage. Apple is also expanding this in iOS 18 with a new Tap to Cash feature that will let you securely transfer money just by holding your iPhone near theirs, similar to the NameDrop feature that came to iOS 17 last year, with no need to know someone’s phone number or email address first.

This makes Apple Cash one of the easiest platforms to use among Apple fans. It works on the iPhone, iPad, Apple Watch, and even the Apple Vision Pro, but oddly, not the Mac — and, of course, non-Apple users are left out entirely. Money is sent from your Apple Cash balance, if you have one, or transferred from a debit card using Apple Pay. There are no fees to send or receive money under any circumstances; Apple doesn’t allow credit cards to be used to fund Apple Cash, thereby avoiding any need for the typical 3% hit. This lets it be a nearly zero-fee platform.

The only place where you’ll encounter a fee is if you want to do instant transfers. Like other platforms, you can move your Apple Cash balance into your linked bank account at no charge if you’re willing to wait 1–3 business days for it to happen. If you’re in a hurry, however, you’ll face a 1.5% transaction fee, with a minimum of $0.25 and a maximum of $15. That’s slightly better than Apple’s competitors, but it’s still best to plan ahead and avoid the fee entirely.

In keeping with its Apple Pay integration, Apple Cash also gives you a virtual debit card in your Apple Wallet that you can use to spend your balance. This was originally on the Discover network, but Apple switched to Visa Debit in 2022. There are no fees for spending from your Apple Cash balance in this manner other than the usual foreign transaction fees that most debit cards incur if you’re traveling abroad. With iOS 17.4, you can also create a virtual card number directly from Apple Wallet so you can spend money from your Apple Cash account on websites that don’t support Apple Pay.

However, like Venmo, Apple Cash is only available in the U.S., so you won’t have to worry about international transaction fees since you can’t send money to anyone outside the U.S. As for limits, Apple is much more transparent about these than many other person-to-person payment companies, and they’re simple, too: the magic number is $10,000 almost entirely across the board.

That’s how much you can transfer between Apple Cash and your bank account in a single transaction, how much you can send in a single iMessage, and the total amount you can send in a rolling seven-day period. That seven-day limit increases to $20,000 for moving funds from Apple Cash into your bank account each week, but the seven-day limit for moving money into Apple Cash is still $10,000. The minimum add is $10, and the smallest amount you can send is $1.

Those limits are lower for Apple Cash Family members, which is another nice bonus of the Apple Cash system. Unlike other mobile payment providers, which typically require users to be at least 13 years old, Apple Cash allows parents to set up a prepaid spending account for even younger kids. Although only teens can use a debit card to add money to their own Apple Cash accounts, parents can transfer funds to an Apple Cash card on a Family Setup Apple Watch or a child’s iPhone to let kids have some of their own spending money.

Which one should I use?

Your choice of payment service might already be partly dictated by what those in your social circle are using, but there’s no need to follow the crowd or stick with just one.

If you’re firmly entrenched in the Apple ecosystem, Apple Cash is by far the best of the bunch since it has virtually no fees, and it’s already available on nearly every Apple device. The limits are generous and easy to understand, and you don’t need to install any additional software or sign up for any new accounts. You only need to activate the Apple Cash card, although you’ll have to provide a piece of government-issued ID and social security number to verify your identity, as Apple has no provision for unverified accounts.

For cross-platform support, Venmo still leads the pack. It’s widely used and easy to set up, and you don’t need to jump through extra verification hoops to use it to send smaller amounts of money. Cash App comes in as a close second to that and comes out ahead for having the most straightforward user interface and frictionless sign-up process.

While PayPal is a household name, it’s hard to recommend for person-to-person payments due to its higher and more complicated fee structure. Still, it’s not a bad choice if you already use it for other reasons. It’s almost universally accepted in the professional world, although since PayPal owns Venmo, you’ll find both are accepted in the same places for retail transactions.

Lastly, your financial institution may provide its own peer-to-peer funds transfer services. These have become increasingly popular in recent years through services like Zelle, allowing you to send money to friends directly from your bank account, often with fewer complications and lower fees.