Something smells foul. AT&T’s biggest rival, Verizon, has gone on record supporting the merger. Though the company has stayed neutral since the merger talks began, Verizon CEO Lowell McAdam now says that AT&T’s proposed $39 billion merger with T-Mobile is inevitable and okay.

“I have taken the position that the AT&T merger with T-Mobile was kind of like gravity,” said McAdam at an investor conference this week. “It had to occur, because you had a company with a T-Mobile that had the spectrum but didn’t have the capital to build it out. AT&T needed the spectrum, they didn’t have it in order to take care of their customers, and so that match had to occur.”

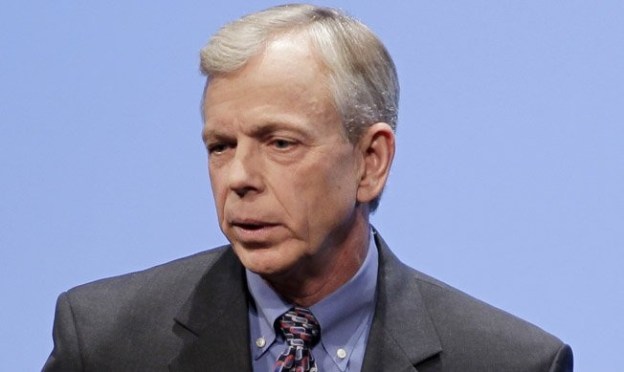

The statement is particularly odd considering that back in March, when these allegations were announced, Verizon Wireless President & CEO Dan Mead was in a CTIA panel with Sprint CEO Dan Hesse and AT&T Wireless chief Ralph de la Vega and refused to comment at all. Since then, Verizon has stayed completely out of the argument. Why would executives now reveal hidden favor for the deal? McAdam reveals that the deal could mean “regulation without actual regulation.”

“We need to be very thoughtful on what the impacts would be to the overall industry if this is a way to regulate the industry without actually passing regulation,” said McAdam.

There are many reasons why Verizon could be for this deal, but the timing couldn’t be better for AT&T. The U.S. Justice Department recently filed suit against the proposed merger.Perhaps it thinks it can snatch up T-Mobile defectors in the event of a merge or maybe an AT&T with $39 billion less cash is an appealing proposition. Or maybe the carrier has already seen what a bad merger can do to a carrier (see: Sprint and Nextel). In any case, currently this was just a statement at a conference. If Verizon does more than rattle cages from afar, then things will get interesting.